GM - this is The Snapshot, edition #153.

This is what I’ve got for you this week.

This Week In Web3 - Crypto bloodbath & $1 trillion wiped off stock market

Sponsored Post - Lil Nouns 2024 Round Up

Notable Sales - Punks, XCOPY, Penguins

Investment Focus - Protecting Capital

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - Crypto bloodbath & $1 trillion wiped off stock market

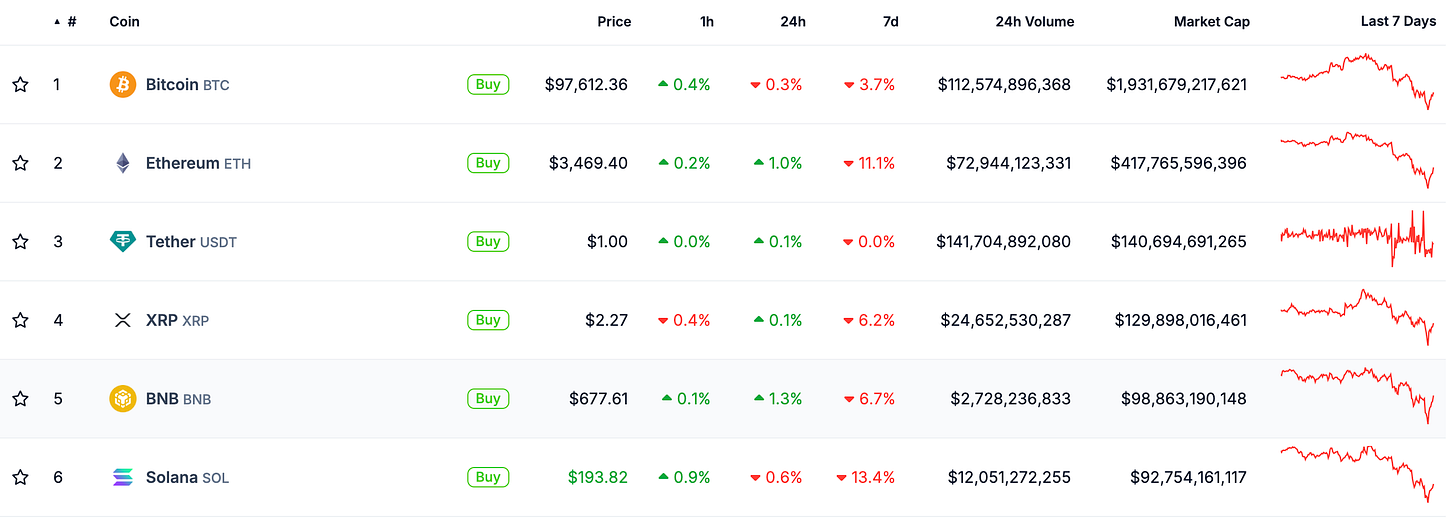

Crypto majors pull back hard on Thursday after bearish FOMC: BTC down to $101K, ETH down 5% to $3.6k, SOL down 3% to $208 & $1+ trillion wiped off US stock market

“Though Fed officials at their September meeting projected four interest rate cuts in 2025, projections today show they are expecting only two for next year.

The move to ultimately lower interest rates while hinting at fewer cuts next year signalled a relatively hawkish sentiment moving forward, said John Haar, Managing Director at Swan Bitcoin.”

After the bloodbath yesterday, it has only got worse today (though we have bounced a bit).

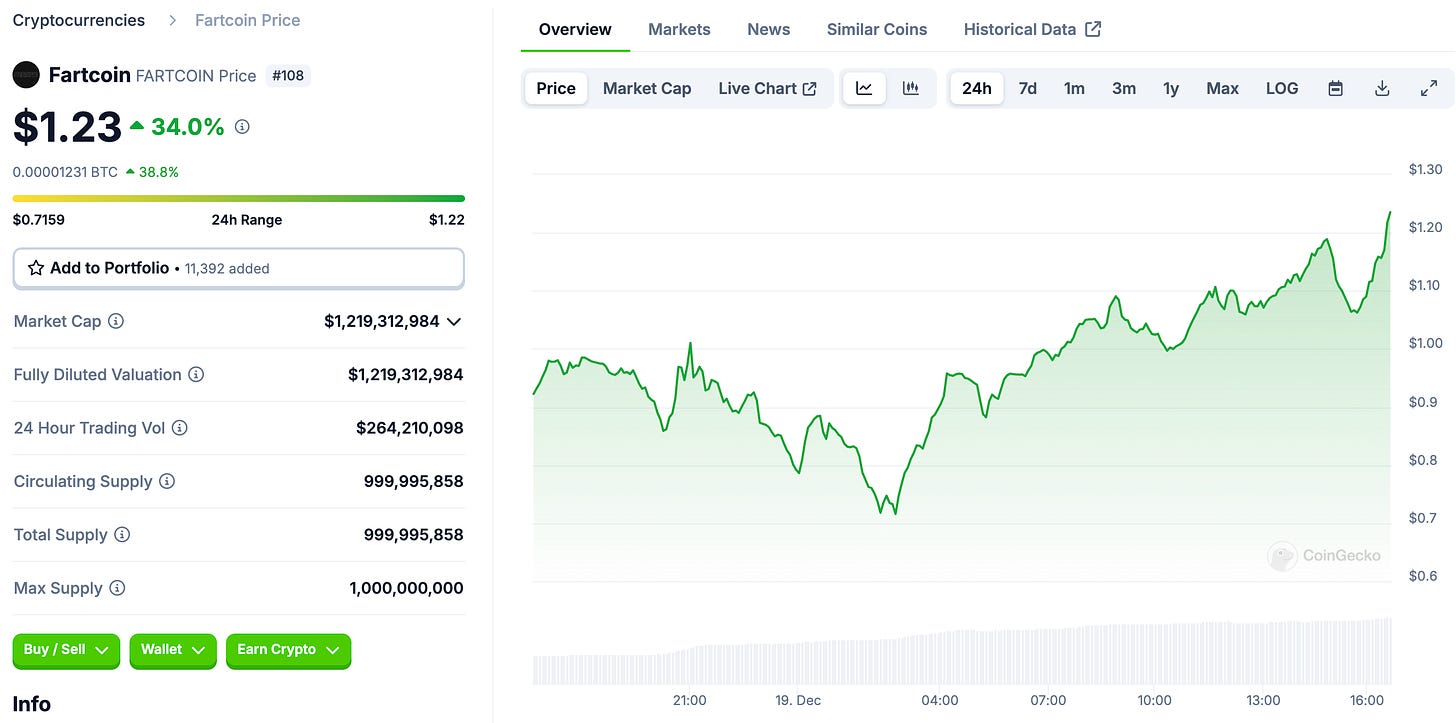

Fartcoin up 34% past $1B FDV this week - and only pull back 1% against broader market crash

"EX-@Bridgewater EXECUTIVE @BobEUnlimited SAYS “IF FARTCOIN IS GOING PARABOLIC, MAYBE MONETARY POLICY IS FAR FROM ‘VERY RESTRICTIVE’”

PENGU launches as 74th largest coin: settles at $2.1B FDV after immediate launch around $4-5B

Crypto asset manager @BitwiseInvest has launched a @solana staking ETP in Europe with the ticker $BSOL

"The move comes less than a month after Bitwise signaled its plans to list a solana ETF in the US by registering a statutory trust in Delaware. Bitwise’s decision to build out its SOL staking infrastructure could also give it the capacity to offer staking rewards for its US spot SOL ETF. Current US applications all have staking rewards stripped out due to securities law concerns, but some are speculating that might change under a Paul Atkins-led SEC."

Ripple rips 7% as it begins rollout of RLUSD stablecoin

"Ripple will launch its US dollar-pegged stablecoin, Ripple USD (RLUSD), on Dec. 17 on the XRP Ledger and Ethereum. According to the Dec. 16 announcement, each RLUSD token will be fully backed by US dollar deposits, government bonds, and cash equivalents. The stablecoin will initially be available on Uphold, Bitso, MoonPay, Archax, and CoinMENA. In the coming weeks, the firm plans to expand to prominent platforms like Bullish, Bitstamp, and Mercado Bitcoin."

"USDtb functions like a traditional stablecoin such as USDC or USDT, utilizing cash and cash-equivalent reserve assets to back each token Blackrock's BUIDL represents the vast majority of the USDtb backing, currently the highest BUIDL allocation of any stablecoin in the market"

Pudgy Penguins hit 35 ETH floor before pull back to 18 ETH after $70-$80,000 airdrop to holders

Sponsored Post - Lil Nouns 2024 Round Up

As Christmas approaches I wanted to take the opportunity to look back over the last few weeks / months at what Lil Nouns has achieved and funded.

I am super proud to be partnered with a DAO that is routinely backing creators and community initiatives - and very grateful they have backed me personally for such a long time.

1. Lil Nouns Approve $6,000 Skateboarding Event - The Lil Nouns DAO approved a $6,000 proposal for a two-day event combining skateboarding challenges and environmental awareness, aimed at inspiring children in challenging situations.

2. Lil Nouns Approve 3.65 ETH IRL Miami Event - The PizzaDAO event took place on Friday December 6, 6-9 pm at the Gates Hotel in Miami, where there was also also a Lil Nouns lounge space.

3. Lil Nouns Agree 0.87 ETH Little Things Storybook: Physical copies of zines will be distributed in public on Thanksgiving week. Storybooks will be donated to public libraries and schools on December, for the season of giving.

4. Lil Nouns DAO passed a $5500 proposal to fund the a clean water initiative in Orudu, in the Ogun state in Nigeria.

As you can see, the Lils really back a huge variety of well meaning projects. Delighted to be involved with the Lils.

Merry Lil Xmas.

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life: check out our website.

Notable Sales - Punks, XCOPY, Penguins

CryptoPunk, Tiara - 52.5 ETH

CryptoPunk, Knitted Cap - 49.69 ETH

CryptoPunk, Hoodie - 110 ETH

XCOPY, DOOM Party - 180 ETH

Pudgy Penguin, Ice - 100 ETH

Investment Focus - Protecting Capital

a few reminders and thoughts today on protecting capital from aggressively red market days like today.

recency bias

spoke about this on the show some time ago too.

the market was dead all summer, and suddenly things came to life - which meant all of those specific assets bought around that time which went up were adored.

but there are always coins that go up. sustaining attention is much harder.

in fact, in a bull market it is even harder because there will be even more coins coming for their spot.

getting out of coins i was in just because they went up in october was one way i protected some capital in the last couple weeks (though i did take some losses too because i needed to realise this first - some of these coins are not coming back - why would they? they were only hot for a bit)

always be selling

rather than trying to time the exact top, this cycle i have decided to routinely sell any asset which i am up big on.

doesn’t need to be all in one go - just bits here and there - ideally on up days - but even if not, no harm to sell, because profit is profit.

ultimately this depends on your trading style - this doesn’t necessarily get you the headline 1,000x - but it does get you the majority of the upside (hopefully) + prevent round tripping significant proportions.

have cash

less about protecting capital, but more about taking advantage on days like today if you think we are aggressively over sold.

i’ve never been a person who is “fully allocated” to crypto - and my recent strategy for profits has been something like this:

75% BTC / 25% cash earlier this year (which is basically full port BTC because the rest is for tax); as the year goes on, scale back amount into BTC as BTC goes up and we go deeper into the bull market; until we got to the point where we were going 50% BTC / 50% cash; and now where I am going even more into cash, with occasional BTC buys.

this is obviously highly dependent on your personal situation, how much crypto you own vs the rest of your portfolio etc; but i am finding i am taking more comfort by increasingly taking profit into cash the deeper we get into the bull market.

very comfortable with the scenario that we rip much higher and i am not ‘fully allocated’ because i know you can’t time the top, and having a decent stack of cash is comfy.

hope that’s a helpful train of thinking + hope the bull market is treating you well.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters