GM - this is The Snapshot, edition #82.

Welcome to the new subscribers this week - we are now at 1,976 subscribers!

I write about NFTs/crypto, and solopreneurship in web3.

This is what I’ve got for you this week:

This Week In NFT/Crypto World - DeeKay Mints More Than $500K

Sponsored Post - 4 Out Of 4 For More Than $25,000

Notable Sales - Squiggles, DeGods, CryptoPunks

Thought Piece - Why DeGods Crashed - And How I Knew Before

For sponsorship enquires, please DM me on Twitter.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

Have a great day,

B

This Week In NFT/Crypto World - DeeKay Mints More Than $500K

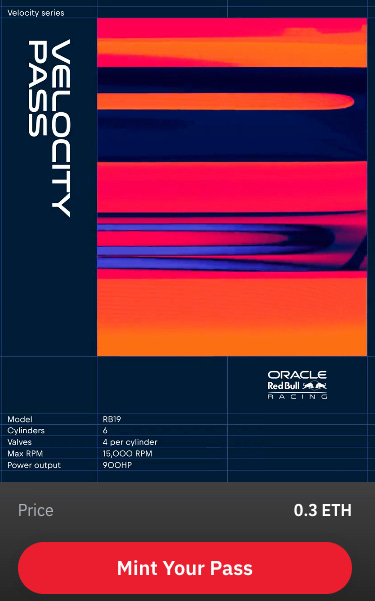

Red Bull Velocity Pass Rapid 3x For Buyers

The Red Bull Velocity pass minted this week at 0.3 ETH ($600) and is now trading at more than 1 ETH ($1,800+) a few days later.

This NFT was made to create a web3 experience that merges speed, technology, and art - and the art will be inspired by the RB19 race car.

Why is it trading at such a high price?

Because there are three great artists involved: Rik Oostenbroek, Per Kristian Stoveland, and Erick Snowfro (the latter being the famous creator of the Chromie Squiggle.)

A reminder that fine digital art is one of best use cases for NFTs - and one of the finest ways for brands to make their digital assets relevant.

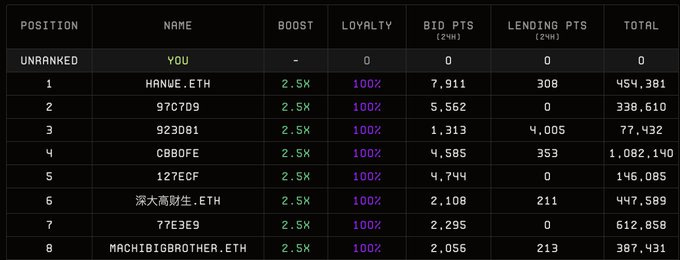

HanWe Makes $1.5M By Tricking Bot

Hanwe - the largest Blur point farmer - recently demonstrated how PvP the NFT market is right now by tricking a bot for 800 ETH.

(Blur, the largest NFT marketplace, is running an incentivised liquidity program, so many whales are providing liquidity by bidding on collections to earn points - and those points will eventually convert to tokens - even though they do not want the underlying asset.)

This was what he did:

He amassed a huge number of points via “trait bids” - bidding on a particular trait of a collection instead of the floor NFTs of a collection;

He noticed others started to copy his strategy - and guessed it was a bot which had been setup to copy him;

He strategically bought a number of specific trait NFTs

Knowing that the bot would copy him, he placed 50 ETH bids on the NFTs he accumulated (which were all worth a lot less than 50 ETH)

The bot obliged and copied his bids: he sold all of his accumulated NFTs to the bot (!)

In regulated markets, my understanding is this type of “bid spoofing” is a form of market manipulation and illegal - though most on Crypto-Twitter reacted against the owner of the bot.

In the end, you have to take responsibility over your precious coins and NFTs!

DeeKay Motion Mints More Than $500K In A Few Hours… And Not Finished

There is nothing better at rapidly unlocking global liquidity than NFTs.

This beautiful digital work - you have to check the animation at the link below - by the famous animator, Deekay, has raised more than $500,000 by selling more than 30,000 editions at $18 each in just a few hours (at the time of writing).

This is one of the only “open editions” by DeeKay - which means it is open for a set period of time in which people can buy as many as they want. And then the primary buying window is closed.

The idea of this “cheaper art” by an artist who typically sells for thousands is to get it into the hands of more people.

There is even a physical claim involved (though not included in the price) so I am interested to see what that looks like for a piece which is natively digital!

Again: digital assets created in the right way by the right people are undefeated at rapidly unlocking global liquidity.

Sponsored Post - 4 Out Of 4 For More Than $25,000

Lil Nouns DAO has passed its last 4 proposals worth a combined $25,000.

From sponsoring skateboarding in Chicago, to an ETH event in Barcelona, to the production of 50 Nounish GIFS - Lil Nouns DAO is always looking for ways to proliferate the Nounish meme and get more people involved.

Your event or idea could be next!

Amazing video by Arash explaining the Lil Nouns

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life:

Check out the latest proposals for more details or reply to this email with any questions you’d like me to answer.

Notable Sales - Squiggles, DeGods, CryptoPunks

CryptoPunk, 0 attribute - 500 ETH ($916,000)

DeGod, Mythic War Armor - 26 ETH ($47,500)

V1 CryptoPunk, Zombie - 45 ETH ($83,000)

Chromie Squiggle, Pipe - 25 ETH ($46,000)

Thought Piece - Why DeGods Crashed - And How I Knew Before

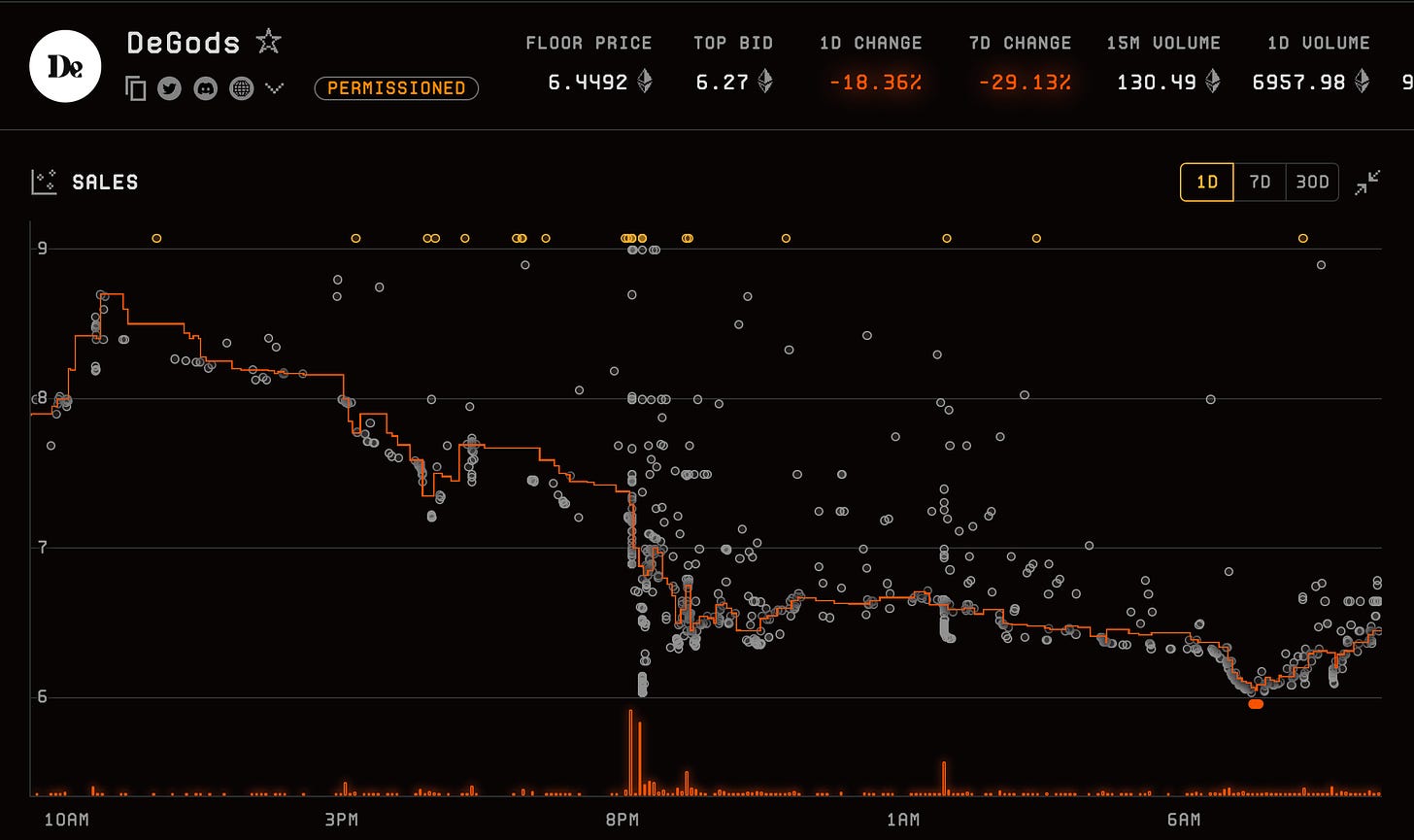

When Frank DeGods planned his team’s Season 3 announcements, I doubt he expected the floor price of their premiere collection, DeGods, to crash more than 20% in less than 24 hours.

But there was a way to predict this beforehand. Let me explain.

Background & the announcement

DeGods and y00ts are two NFT collections by delabs - one of the most famous NFT companies around - and both successful in their own right.

They both began on the Solana blockchain some time ago, after which the founder, Frank, decided to move DeGods to Ethereum and y00ts to Polygon (an Ethereum Layer 2).

Yesterday Frank announced 3 big pieces of news to move the collections forward - both of which caused erratic price action:

y00ts move to Ethereum - this is somewhat controversial because the team had accepted a $3M grant from Polygon to build the y00ts project out on their blockchain. However, Frank confirmed the grant would be returned in full. Why the move? Because they want to “unite” their two collections on Ethereum.

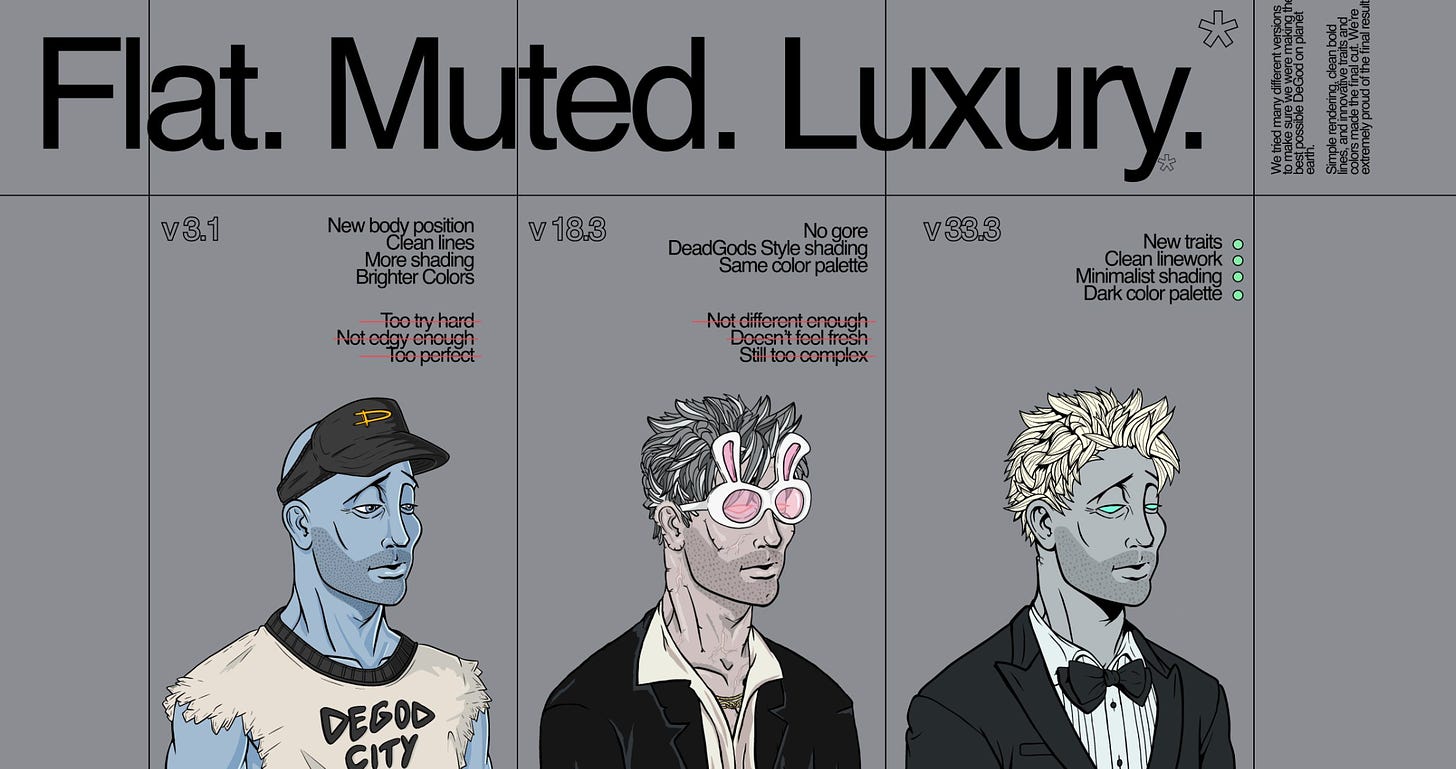

DeGods art change - each DeGod would now have four options (including a female option) AND they look much '“cleaner”.

The “refresh” takes inspiration from luxury fashion brands and tech companies: art and style is constantly evolving and so needs to be updated for the current “season”.

Points Parlour - In order to upgrade to DeGods Season 3 art, holders will need to spend 333 DUST (around $800).

Whilst full details have not been announced at the time of writing, it appears that only Season 3 DeGods will get to “play” in the Points Parlour for prizes.

Why did some people not like the news?

Some people thought it was completely unacceptable that they needed to pay another $800 to participate in the next stage of the ecosystem.

Others thought it was a display of uncertainty to move blockchains again.

Some thought it was completely fine.

Nevertheless, I think there was a much bigger story for why the price went down so hard.

How could we predict a crash by observing the lending market?

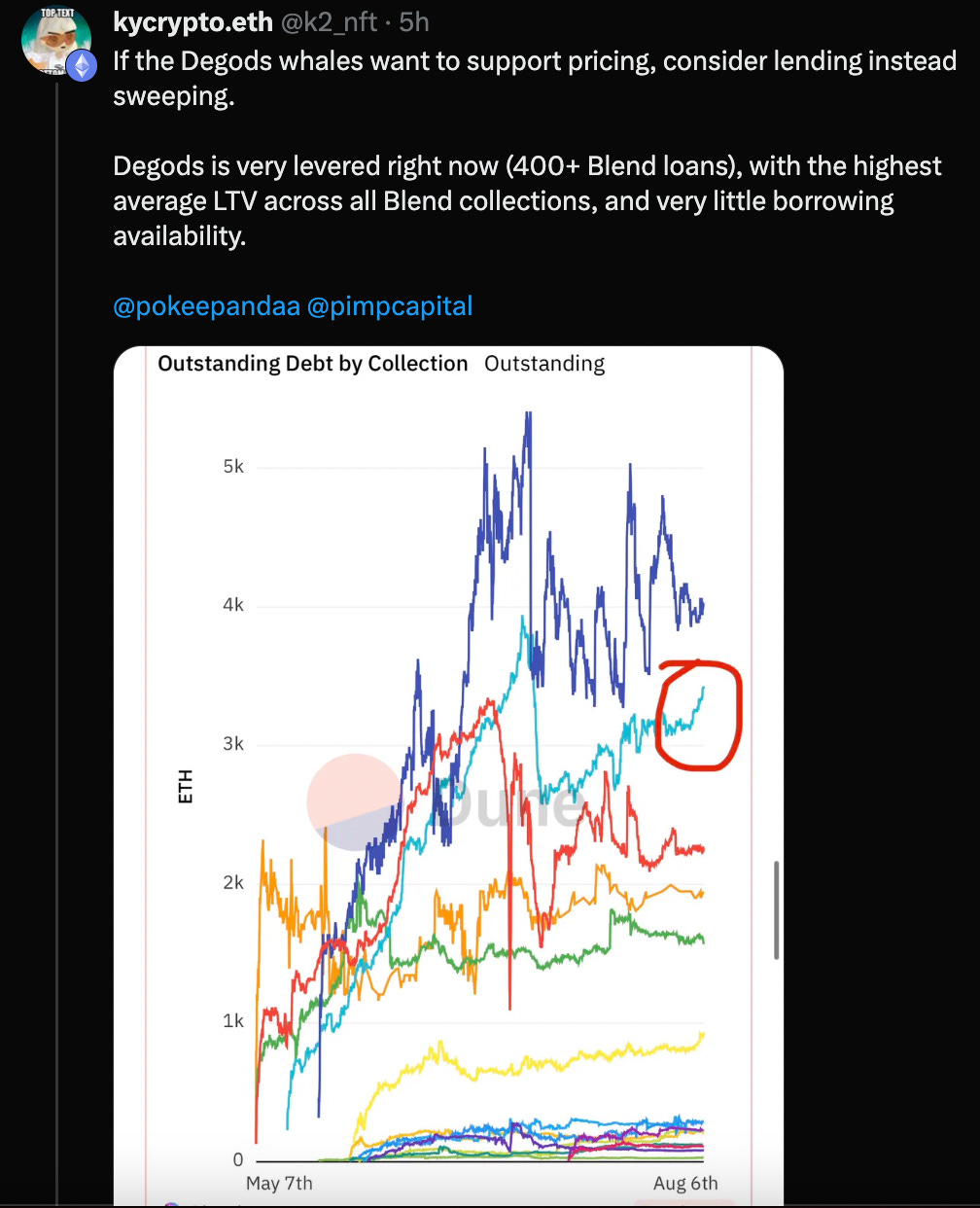

We noticed a while back that there were more leveraged holders in the DeGods ecosystem compared with other ecosystems. Liam Herbst noticed the same here back on July 26.

And this was confirmed today by kycrypto:

Why is this a problem?

Because when the floor price of the collection falls, there are more and more loans on the right side of the vertical line below (which means they have become over 100% LTV loans, those loans will likely be terminated and end soon, and then they will be dumped on to the market, causing a cascade of selling as underwater lenders try to get back however much money they can.)

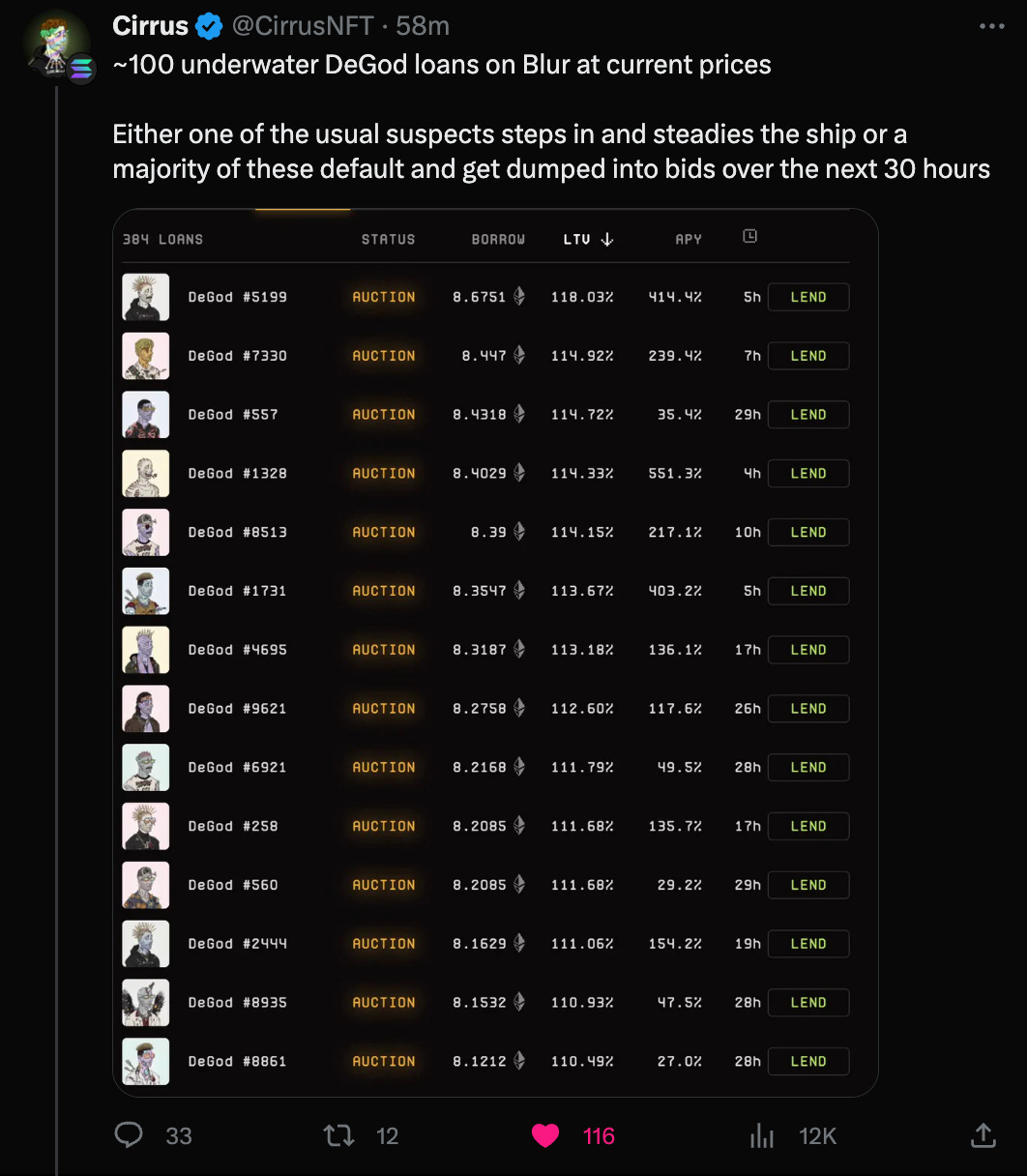

So what is the solution right now?

The solution proposed by one of the most experienced lenders and traders in the game, Cirrus, is that one of the large “whales” need to come in to provide extra liquidity asap.

If this does not happen, we go lower and lower because of the sheer volume of forced sellers due to underwater loan positions.

Ultimately, a highly levered NFT collection makes that collection very vulnerable to any negative sentiment, which can result in this seemingly unstoppable sell pressure.

Hope that was some interesting insight into how the loan market can inform you!

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters