GM - this is The Snapshot, edition #125.

This is what I’ve got for you this week.

This Week In NFT World - Rate Cuts, Crypto Ready For Takeoff?

Notable Sales - Alien Clone X, Memeland Alien, CryptoPunks

Investor Focus - The Fastest USD asset to $3B In Crypto History

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - Rate Cuts, Crypto Ready For Takeoff?

BTC ETF inflows tremendous but price not mooning - why not

There has been 17 consecutive days of BTC ETF inflows. BTC price has gone up - but not as much as people might have expected with that level of buy pressure. Why not?

Because that buying does not likely represent the full amount of risk being taken by traders.

This was a goat explanation on the basis trade + why BTC may not be mooning by @osf_rekt this week:

“Possible explanation for why BTC is not sending despite massive inflow number: Big increase in BTC OI [open interest] + big ETF inflow coinciding suggests to me tradfi ppl growing that basis trade (long ETF vs short futures). BTC funding is back up to 20% atm so that makes sense --> this is a representation of ballpark apr that would be made from this delta neutral trade.

What this means is the net inflows into BTC ETFs aren't always a representation of increase in net risk; we have to look at OI [open interest] + funding rates to try guess a clearer representation.

The thing that is funny though is that as more people go levered long BTC, funding rates go higher, and then tradfi buys more BTC ETF to grow their basis trade, but the headline numbers make people think BTC is about to moon.

Then, smarter actors dump BTC to wipe out levered longs and people get confused why BTC is not sending despite the massive inflow numbers...it's because they aren't always a true representation of net risk changes.”

Van Eck report goes hyper bullish on ETH

Traditional investment manager Van Eck quoted some hyper bullish price predictions for ETH in their report this week: target of $22k base case, bull case $154k.

2 interesting points to me:

whilst many have argued that ETH is less well understood vs the btc digital gold narrative, it appears they have an excellent handle on ETH’s diverse qualities: (i) digital oil, (ii) programmable money, (iii) yield bearing commodity, (iv) internet reserve currency

they also interestingly compare eth with web2 applications, and app stores by apple and google - rightly noting eth’s quality as the decentralised fintech stack

I note the timeline has got hyper bullish at the moment, and people expect a breakout asap - not just for ETH, but across the board. (Especially with the rate cuts - more on that in a sec)

As a long term holder, I am comfy.

Canada cuts rates from 5% to 4.75%, European Central Bank followed

Time to hit the club according to Arthur. Rate cuts coming from all angles, which means time to be risk on.

"Bank of Maple Syrup aka Canada cut yday. ECB on deck today, mrkt expects a cut. Risk on, it’s Yachtzee time! This summer a lot more interesting than I expected. See y’all at the clerb."

The background you might like to know aside from it being the time for the club:

"The BoC decision follows rate cuts from central banks in Latin American countries such as Mexico, Brazil and Chile this year, but it is the first member in the G7 to make the move. Traders expect other member countries except Japan to loosen monetary policy in the coming months. The European Central Bank, which governs monetary policy in France, Italy and Germany, is widely expected to make its first cut of the cycle this week. The Bank of England is forecast to do the same this month."

Context from FT

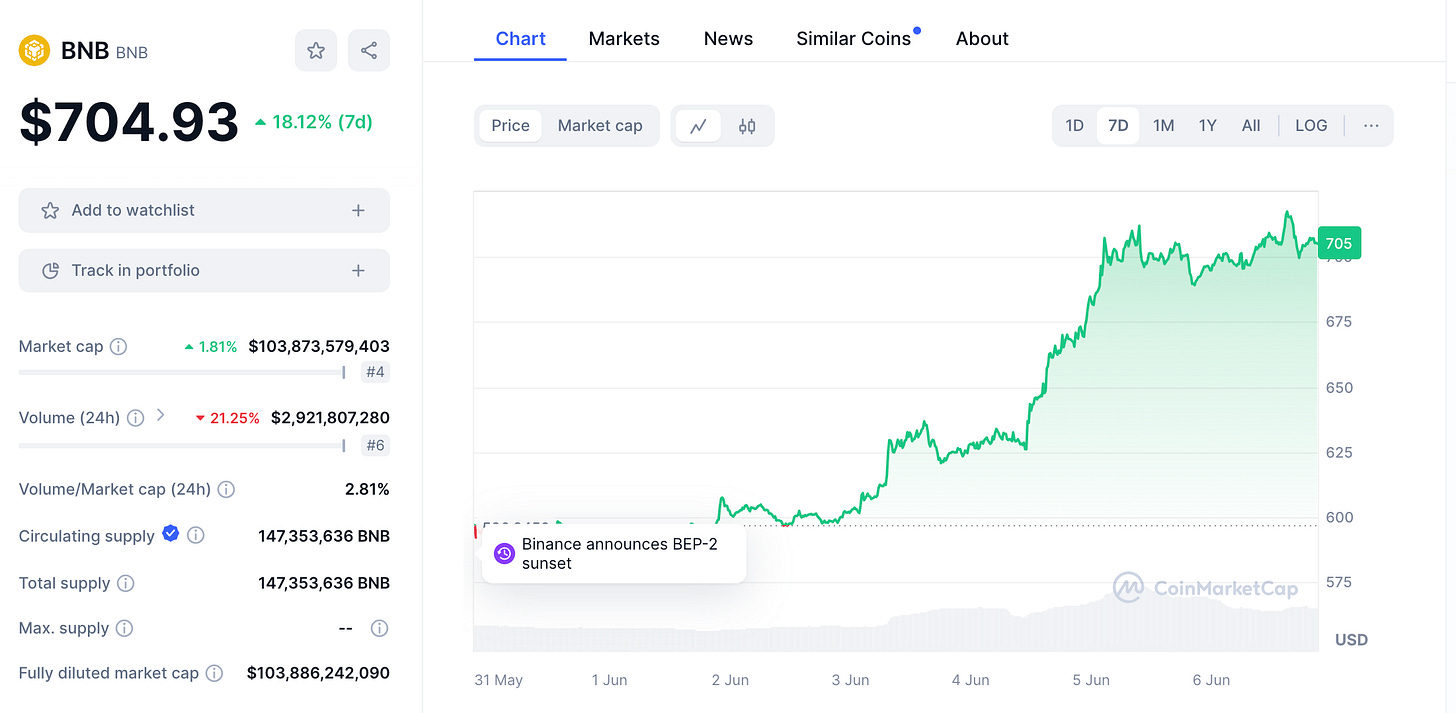

BNB reaches $700 + $104B marketcap: 2nd major this cycle to hit ATH

I am sure it would not have been expected that it would be BNB, the Binance Coin, to be the second major to hit ATH after BTC this cycle.

Up almost 20% this week, it crushed through $700.

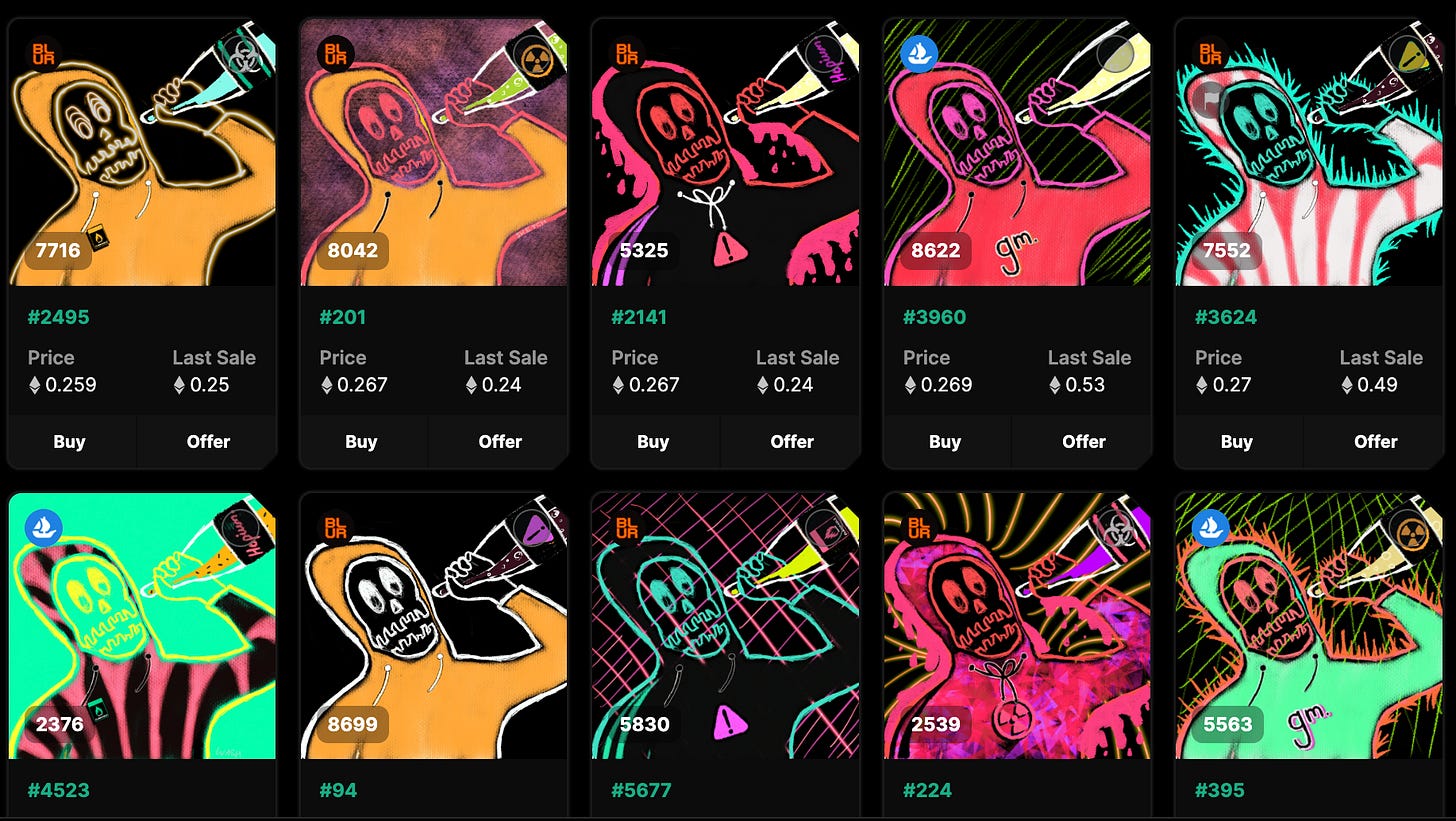

OSF announces Rekt brands equity share for Rekt NFT holders

On the NFT side of things, very cool to see NFT holders of the Rekt Guy collection receive a share of equity in Rekt Brands, by OSF.

The thesis is roughly this: you have thousands of holders of an NFT that are invested in pushing your brand and making it go viral - your first 1,000 superfans on steroids.

Good luck to the boys!

Notable Sales - Alien Clone X, Memeland Alien, CryptoPunks

Clone X, Alien - 18.88 ETH

CryptoPunk, Nerd Glasses - 29 ETH

CryptoPunk, Mohawk - 38 ETH

Captainz, Alien - 34.69 ETH

Investor Focus - The Fastest USD asset to $3B In Crypto History

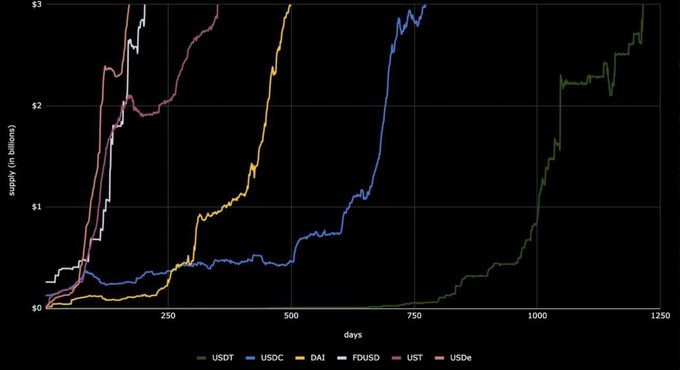

Ethena is the fastest USD asset to reach $3b in crypto history.

It has already given us one lucrative airdrop, with its coin ENA trading at $15B marketcap + its second airdrop is coming soon.

This is why i like the exposure and how i am tying it in with some @Blast_L2 farming.

Size of opportunity and yield

Whilst some describe Ethena as a "stablecoin" because it is going after the stablecoin market, Ethena's USDe is best described as a synthetic dollar because it is not backed by dollars.

A quick point on the size of the opportunity:

Stablecoins and other relatively stable, fully-backed assets intended to approximate the dollar is one of three $1 trillion+ opportunities in this space, with an immediate ~$5bn+ addressable market by embedding USDe into exchanges and capturing market share within DeFi as a reserve asset.

h/t @ethena_labs

So this is a big deal, but what is USDe actually backed by?

USDe is backed by a “delta-neutral” ETH position in other words, each USDe is collateralized by a long staked ETH (stETH) position which is simultaneously offset by an equivalent ETH perpetual futures contract (ETH-PERP) short position

Positive Delta (stETH) + Negative Delta (Short ETH-PERP) = Delta-Neutral (USDe)

Consequently, if the price of ETH moves from $3000 to $2500, the short ETH-PERP position will subsequently offset the $500 price swing; similarly, if the price of ETH increases to $3500, the short ETH-PERP position will subsequently decrease $500

h/t @Delphi_Digital

Because funding and basis spead has historically generated a positive yield given the mismatch in demand and supply for leverage in crypto, this is where the interest comes from (when you stake your USDe to make it sUSDe).

Next airdrop soon

The 2nd airdrop is planned for September 2nd 2024, or when USDe supply reaches $5bn, whichever comes first based on how things are going, looks like it should be sooner than September.

Top backing

Backed by Arthur Hayes, Cobie, Ansem, and top funds.

Risks

Multiple risks here, and you should read more about them at the link provided:

- funding risk - liquidation risk - custodial risk - exchange failure risk - collateral risk

Further reading: https://ethena-labs.gitbook.io/ethena-labs/solution-overview/risks…

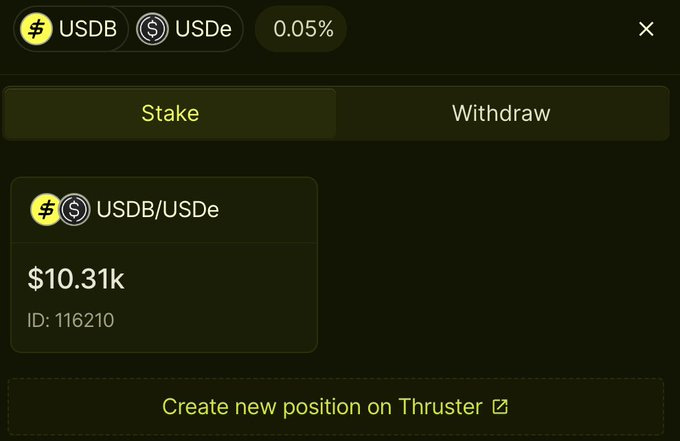

How to get ENA airdrop AND Blast/Thruster exposure

This is what i like to do: find a way to get exposure to multiple things i am bullish on at the same time (ENA + Blast) and this is what i have done:

1. Buy some USDe on Ethena

2. Bridge USDe to blast using @StargateFinance

3. Use @ThrusterFi to provide liquidity for USDe/USDB pool

Providing liquidity will get you:

- Maximum Ethena 30x sats boots (Sats are Ethena's points system - you get boosted for what you do with your USDe)

+

- Blast Gold and Thruster Credits

4. Stake on @hyperlockfi

For an extra 5x sats + a share of gold to be distributed to stakers over the next few days as part of a 'gold rush'

It might seem like a bunch of things to do, but I like this RELATIVELY lower risk trade because I am operating in USD assets + getting exposure to two things I am bullish on at the same time (ENA + Blast).

As always, dyor, be comfortable with the risks based on your own profile and good luck.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters