GM - this is The Snapshot, edition #87.

Welcome to the new subscribers this week - we are now at 2,028 subscribers!

I write about NFTs/crypto, and solopreneurship in web3.

This is what I’ve got for you this week:

This Week In NFT/Crypto World - Social-Fi defeats NFT Market

Sponsored Post - Lil Nouns New Funding For Marketing & Developers

Notable Sales - CryptoPunks, Nouns, ACK, Otherdeed

Funding Update - Animoca Brands secures $20M funding led by CMCC Global

For sponsorship enquires, please DM me on Twitter.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

Have a great day,

B

This Week In NFT/Crypto World - Social-Fi defeats NFT Market

Social-Fi defeats NFT Market

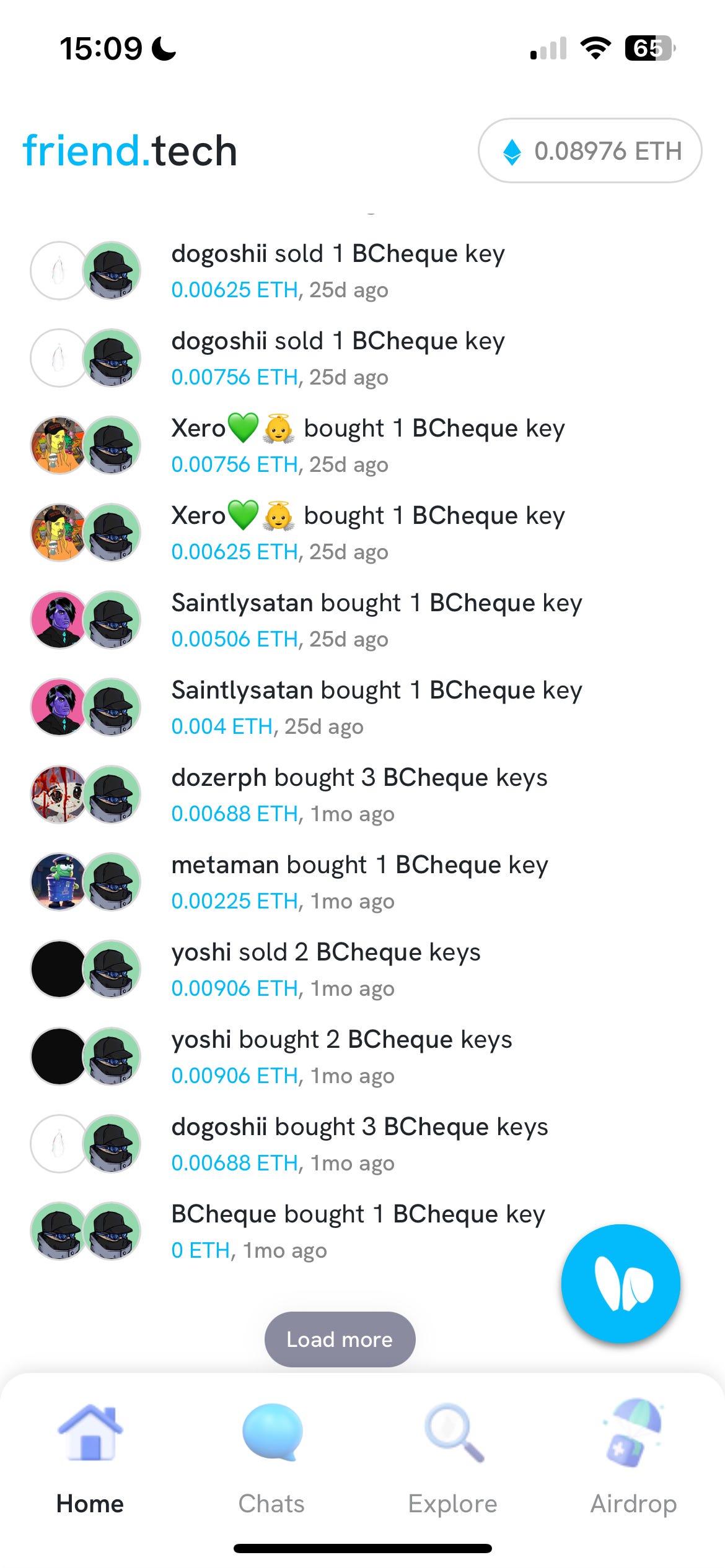

FriendTech has exploded this week and captured the minds (and wallets) of all of the crypto crowd.

FriendTech is an app where users can buy and sell keys (shares) of their friends (what could go wrong?!)

The shares start super cheap, and then go up on a steep bonding curve - you can see how each key gets more expensive here.

You also earn fees on your shares being traded (!)

Whilst there does appear to be some product market fit here for creators who may want to gate certain content, it has also naturally attracted speculators who see the price go up and want to participate in that upside.

(It is also funded by prominent VC Paradigm and there will be an airdrop, so in that sense a lot of this activity is “airdrop farming”)

A few stats:

The first account reached a $4M marketcap: Racer (one of the founders)

More than 10 other accounts have a market cap of over $1M

One day this week there were more wallets trading FriendTech keys (9747) than wallets trading ETH NFTs across major exchanges (9100).

The marketcap of all of the people together on the platform is now $98M!

Will report next week on where we go from here as this is the most hype there has been around a product in crypto for a while.

Manifold facilitates creator minting via claim code

Claim Code Minting is significant. This implementation by Manifold means you no longer need wallet addresses or an allowlist to gate a mint.

This will be particularly useful for a live experience where you can tell your audience a secret word which they can use to mint the NFTs you have ready for them.

This is significantly better than you as a creator needing to gather lots of people’s wallets to whitelist them.

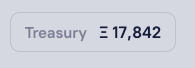

The Nouns DAO treasury sliced from 28k ETH ($44M) to 17k ETH ($27M)

Many Nouns DAO participants are quitting the DAO as almost 40% claim a refund on their huge NFT investment.

For context, Nouns DAO is a collective of around 800 people who “bought in” to the idea of funding cool stuff together. There was a $40M+ treasury. (One new Noun is released into the world each day, and at the moment they sell for almost $70,000).

A fork was planned, however, because certain holders who paid 60, 70, 90, 100+ ETH for a Noun did not like how the treasury was spent (and did not enjoy how the price of Nouns had dropped to as low as 20 ETH).

Now they can take back their "share" of the treasury by voting out of the DAO.

It was never obvious to me that any participant in a project has proportional share of the treasury.

The argument for the fork is that it is a "minority protection" mechanism - such that if the DAO is captured, a minority can at least make away with some of the funds.

Whether you agree or disagree, it is fascinating to see the political intrigue and arguments over DAO funds: we will see more of this.

FTX is awaiting court approval to liquidate an estimated $3.4 billion liquid portfolio

Not all coins will be equally affected by the FTX sell off - which is happening now that liquidators are ready to start trying to make customers whole again after the exchange’s embarrassing and catastrophic bankruptcy.

According to this chart by Messari:

👉 Solana and Aptos have the highest sell pressure to volume ratio at 81% + 74%, respectively

👉 TRX, DOGE and MATIC have reasonable sell pressure to volume ratio at 6% + 12%

This suggests that those coins with the highest sell pressure to volume ratio would experience the most downwards volatility.

2 points to note:

- Many of the SOL and Aptos tokens are locked for now because they are vesting tokens which are not immediately liquid on open markets

- Giga-whale Justin Sun has said he will simply buy all of the TRX (!)

Sponsored Post - Lil Nouns New Funding For Marketing & Developers

Lil Nouns DAO is back with a series of funding opportunities for you to win up to 0.15 ETH + a Lil Noun NFT.

For this round Lil Nouns DAO is looking for art, video, design, webpages, social campaigns, and whatever other cool stuff you can think of that best showcases Lil Nouns.

This is a retroactive funding opportunity, meaning you need to submit a finished project so that Lil Nouns holders can vote to decide on who wins the funding.

There is also a developer funding round going live soon for our more technically minded enthusiasts.

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life check out this funding round for more details.

Notable Sales - CryptoPunks, Nouns, ACK, Otherdeed

CryptoPunk, Clown Eyes Blue - 45.5 ETH ($73,000)

Noun, 586 - 35.3 ETH ($57,000)

ACK, Last Orders - 14.2069 ETH ($22,000)

Otherdeed - 15 ETH ($24,000)

Funding Update - Animoca Brands secures $20M funding led by CMCC Global

Animoca Brands is one of the biggest gaming companies in the world. And they have just secured significant funding to build out their Web3 project, Mocaverse.

🔹Deal Detail: Investors acquired shares at A$4.50 (~$2.87) each, granting investors a free-attaching utility token on a 1:1 dollar basis.

🌍 Backstory: Animoca is behind 'Mocaverse', an NFT collection which is split into 5 unique 'tribes'. The project launched with 8,888 NFTs in Dec 2022. Partnerships have grown too, with a notable tie-up with CyberConnect last month, aiming to elevate the Mocaverse community with gamified social layers.

🚀 Vision Forward: Animoca has more than 450 portfolio projects. The funding will be used to drive adoption across their various projects and for product development.

🆔 Sneak Peek: Keep an eye out for 'Moca ID', a unique non-transferable NFT designed to weave on-chain identities, bridging users and the Mocaverse. Besides offering interoperability, it promises to reward active contributions with loyalty points.

Whilst this raise is significant and a success in a bear market, it can be compared with the $450M Yuga Labs and $100M Pixel Vault raises when the market was more speculative in early 2022.

Ultimately it is still positive to see significant funds being poured into the digital asset market by a very significant gaming player.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters