GM - this is the BCheque Papers, edition #56.

Welcome to the 66 new subscribers this week - we are at 1,447 subscribers now!

I write about NFTs/crypto, and trying to make it independently in web3.

This is what we’ve got this week:

This Week In NFT World - Multiple $1M+ sales

Sponsored Post - Nouns Builder

Risk On - Pepe Checks marketcap doubles in days

On The Horizon - Ordinal NFTs

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week in NFT World - Multiple $1M+ sales

Kevin Rose sells Zombie Punk for $1.4M

Kevin Rose, founder of PROOF and Moonbirds, has sold his “grail” Zombie CryptoPunk for $1.4M.

He has been selling many NFTs in the last few days after he was hacked for more than a million dollars worth of NFTs.

Completely fair enough - I would do the same!

Sorare Giannis 1/1 unique card sells for $179,123.27

The auction for the 1/1 unique Sorare card of Giannis Antetokounmpo ended at a final price of 113 ETH ($186K).

Sorare just last week announced its expansion for fantasy sport into the English Premier League - which I am looking to play!

Send me a message if you join and want to chat about it.

This week a gold Bored Ape was sold for 800 ETH ($1.3M).

It was sold by prominent NFT collector, j1mmy.eth. This is what he bought with some of the proceeds…

Twin Flames resells for 111 ETH

A photograph from the prominent Twin Flames collection by Justin Aversano has resold for 111 ETH ($185,000).

The other most recent sales from the collection have been between approximately 38 and 43 ETH ($60k - $70k)

Vince Van Dough raises $1.6M with Checks derivative

The Pepe Checks derivative created by Vince Van Dough - a prominent digital art collector - was minted 237,869 times.

They were sold at $6.9 each and the total sale raised 975 ETH ($1.6M). Think there might be more than meets the eye here - more on this later!

Dingaling acquires 7 Ordinal Punks

Dingaling, one of the biggest NFT collectors, spent 15.2 BTC (211 ETH / $345,000) on 7 Ordinal Punks.

Ordinal Punks have taken the NFT market by storm this week as people are intrigued by Ordinal NFTs - the on-chain, L1, “NFT” system for Bitcoin.

There is currently no marketplace or way to trade these in a trustless way (!) Orderbooks are currently being updated on shared spreadsheets and sales are done OTC or via escrow!

Fortunately I have some good resources to share later if you want to dig deeper and not (potentially) lose all of your money.

Sponsored Post - Nouns Builder

Starting a DAO just went from a complex pipe dream to a legit option for you.

Legal aside, Nouns Builder can help you upload your art, start a DAO, and create as a community right now - all on chain, no code required.

Why would you want to start a DAO instead of doing things the usual way?

Here’s the vision:

What if…

Instead of relying on corporations,

we created together and relied on each other?

Instead of just creating short-term revenue,

we created lasting resonance?

Instead of trusting hidden systems,

we did everything openly onchain?

Instead of working together feeling like work,

it could feel like an endless jam session?

Nouns Builder exists in this spirit of invitation and co-creation.

And in practice it is making A LOT more things possible for you because you can connect your DAO to an app as easily as connecting a wallet. Via certain proposals you can:

Stake ETH

Stream salaries

Put forth proposals

Generally operate your DAO just like a wallet!

Nouns Builder is opening a door to you and the fun future of work is on the other side.

Walk through here: Nouns Builder Website + Nouns Builder Discord

Risk On - Pepe Checks marketcap doubles in days

Many people ask me: how do you find out about NFT projects early enough?

In this article I will show you how to keep your eyes open - step-by-step.

I will also explain why The Pepe Checks are interesting - and why there is speculation surrounding them.

The Pepe Checks derivative created by Vince Van Dough - a prominent digital art collector - was minted 237,869 times.

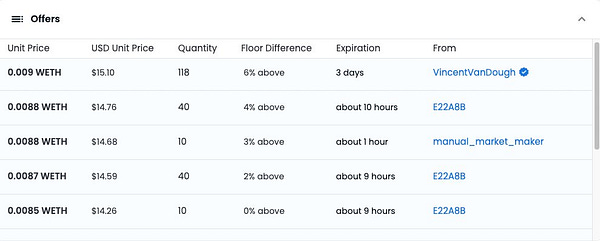

They were sold at $6.9 each and the total sale raised 975 ETH ($1.6M). They are now trading at around $14 each.

Why were so many of these NFTs bought at the primary sale? And why are people buying them up on the secondary market?

There are two big reasons pre-sale; one smaller reason pre-sale; and a couple of factors now for secondary volume.

Vince Van Dough

Vince Van Dough’s bio does not fully reveal his importance or standing in the space.

If you did not know otherwise, you may mistake him for just any other NFT degenerate who is a “purveyor of shitcoins and fine art.”

Vincent Van Dough Twitter Profile

He is not just another NFT trader or collector.

His wallet has collected more than 4k NFTs. Here are just 6 bought for 300 ETH in total ($465,000 at current value, likely higher at time of purchase)

He is leading The Art of This Millennium Gallery . This digital gallery represents an all-star group of artists in the space.

He has been instrumental in developing the Rare Pepe ecosytem, NFTs on Bitcoin.

He was involved in collecting art for huge prices under the Starry Night banner with 3 Arrows Capital (Kyle Davies and Zhu Su’s trading firm which was one of the biggest in the space before blowing up)

The point being: he has been around for some time buying, collecting, establishing relationships, and helping to build out the ecosystem.

If you didn’t know that, you would not have recognised the opportunity.

With that level of expertise and influence in the space, what he focuses on or produces will get attention.

Checks

Jack Butcher’s Checks project blew up in January.

It went from a mint of $8 to a $3000+ floor over the course of a month.

It has captured the minds of many big artists, collectors, and thinkers in this space.

That is why I wrote about it in last week’s paper: $8 to $2,600 In 30 days

Without the success of Jack’s project, Vincent Van Dough’s derivative would not have existed.

But not only did Jack’s project sustain; Jack changed the metadata of his Checks project to show the image of Vincent Van Dough’s Pepe Checks project.

This added rocket-fuel to the project (because obviously…see Pepe Check…buy Pepe Check!)

Flywheel

Whilst not necessarily a “catalyst” like the underlying value proposition delivered by the artists/producers already mentioned, Pepe Checks were also on my radar via my friend Flywheel, who presents his theses to his group.

My understanding is he has quite a track record of predicting successful projects. So much so that I was happy to join to hear his perspectives.

He mentioned the project early to his circle - and that appears to have worked out well for those who got involved.

Being a part of these types of conversations early is important when evaluating a new project.

Derivatives

Lots of derivatives is always a positive for a project because it shows that the underlying project has a memetic quality and people want to reproduce it in some way. Derivatives sprung up rapidly for this project.

I present here a few which caught my eye and made me smile.

The speculation begins

*Here a bit of Twitter and on-chain sleuthing is required*

Once the mint finished I saw this from moon (big crypto/nft trader).

This made people think something might be “planned” for the collection.

We then saw this tweet from VVD himself - suggesting a burn (where you burn NFTs in exchange for something else) could be coming.

And I also saw that VVD was buying his own creation post-mint. (Nice to see after I had bought in on the above speculation..)

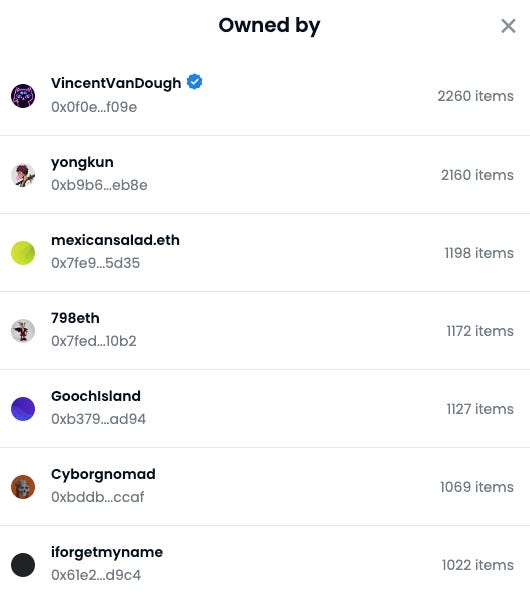

So much so that VVD became the second largest holder quickly.

And he has subsequently become the largest holder (2260 NFTs) in short time.

Seeing this sort of backing by the founder gives me some confidence that the NFTs themselves will be useful for something. (Of course, without any official announcement, you can never know…)

When you think about the collection in terms of marketcap, this NFT collection is at approximately $3.3M.

Not that high for a prominent NFT collection; and certainly not high for an altcoin marketcap (many of which trade at many multiples higher for no good reason at all.)

Whether it is right to consider this NFT as an “altcoin with a picture” and make this comparison is yet to be confirmed.

His latest tweet is this.

I do not know what it means (!) but I think the likelihood of nothing happening with these NFTs is reducing by the day.

I hope that was (i) a helpful insight into the project; and (ii) a helpful look at the “due diligence” and investigative/analytical process.

As always the content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only. I hold some of these NFTs.

On The Horizon - Ordinal NFTs

This week’s On The Horizon comprises 3 pieces of writing I want to re-read on Ordinal NFTs.

If Evan is right, might as well do a little reading now, right?

I would read dotta’s guide to buying Ordinal NFTs first. It provides excellent introductory information in a reader-friendly Q&A format

I would then read wale.swoosh’s thoughts on “BTC NFTs” as part of a “new meta”. Includes some thoughtful takes on what it will take for these NFTs to actually gain (and maintain) interest and adoption.

To consolidate I would then read the @matthewbarby article on Ordinals and the Rise of Bitcoin NFTs. This is a slightly longer-form more detailed exploration of the workings of these NFTs and their potential significance.

Have a great day,

B

Please do leave me any questions or thoughts here - I respond to every one!

And if you thought this was interesting, please consider subscribing to this Substack and following me @BCheque1 on Twitter for more on NFTs and Web 3.0.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters.