Gm team

This week’s edition is going to focus on QQL - the $17,000,000 art collection sale by Tyler Hobbs and Dandelion - and it’ll also give an insight into my approach on analysing new art releases (the analysis is lengthy because analysis should be in depth!).

Have a great week!

B

Contents

This Week in Crypto

This Week in NFT World

QQL analysis

Thought of the Week

Meme of the Week

This Week in Crypto

FTX acquired bankrupt crypto-lender Voyager Digital by bidding highest at the bankruptcy auction; the deal is valued at $1.4B. FTX are eating everyone! In addition Bloomberg reported that FTX's Alameda Research is considering acquiring assets of bankrupt Celsius.

Korean prosecutors allege that Do Kwon tried cashing out over 3,313 BTC shortly after a warrant for his arrest was released. Do Kwon, who is currently on the run from Korean authorities in a securities violation case, reportedly created a new wallet on Sept. 15, just a day after a Korean court issued an arrest warrant against the fugitive crypto founder. All the while he continues shitposting on Twitter…

Circle announced that USDC (the 2nd largest stablecoin in crypto) will be available on 5 new blockchains in early 2023. The 5 blockchains are Optimism, Polkadot, Cosmos, NEAR, and Arbitrum. Great to have access to the sweet dollar in these current environments.

45% of ETH validators now complying with US sanctions - Censorship fears rise as use of Flashbots’ software may potentially be contributing to censorship within the Ethereum network.

2. This Week in NFT World

3300 ETH ($4,451,633.94 USD) CryptoPunk sale. The 4th highest CryptoPunk sale ever. Was sold by pablopunkasso for $1400 5 years ago - oops!

Apple will allow apps to sell NFTs on the App Store. NFT God is bullish: “These technological gatekeepers have an outrageous amount of power over the landscape. They can single handedly decide which technologies we use and don’t use… They might be taking a hefty fee (which is actually the standard amount for most marketplaces) but the fact that they are allowing blockchain technology, means other ecosystems might be soon to follow.”

Creator of Fidenzas @tylerxhobbs sold out his QQL collection — 900 NFTs at 14 ETH raising a total of 12,600 Ξ ($17,640,000). In secondary market trading they are now trading for 17E (approx. $22,000).

Series of ArtBlocks Curated Collection no more - Series 8 will be the last ArtBlocks designated series, with further groundbreaking collections to be recognised as ‘curated’. ArtBlocks is the leading generative art platform.

3. QQL analysis

a) Headline

Tyler Hobbs and Dandelion sold out their QQL collection — 999 NFTs at 14 ETH each ($18,500) raising a total of 12,600E ($17,640,000).

At the time of writing the collection has done 4240E ($5,645,220) in secondary market volume. With creator fees set at 7%, this will have brought in an additional $400,000 approx. for the creators.

b) Why is it such an interesting art collection?

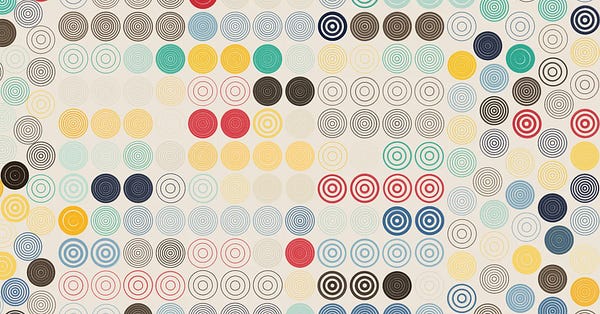

Tyler Hobbs is a generative artist and the creator of the Fidenza - a beautiful and iconic generative output which cannot be bought for less than 96E ($127,817) for a piece from the 999-piece collection.

As Dandelion explains in this introductory video, the collector is included in the curation process:

“QQL is a groundbreaking experiment in fully on-chain generative art…the project is a dialogue between generative artists and their collectors. The artists present prompts of possibility, and the collectors decides what will exist.”

There are 999 mintpasses, which a collector can choose to mint whenever they want (no time limit). They can play around with the algorithm on the website before they decide which output they like best.

You can head to https://qql.art/create to play around with the algorithm and see potential creations

The collector is included in secondary royalties forever - so if the piece they create is sold on - no matter how many times - they will receive 2% of the future secondary sales.

c) Pre-sale action - what to look for before the sale

i) Research - marketcaps and sales histories

Tyler Hobbs has 2 other collections live at the moment.

x) Fidenza - 999 in collection - current market cap approx. $127,000,000 ($127,000 x 999)

Definitely has penetrated digital culture and has emerged as one of the first-thought-of digital pieces of art.

Has experienced some severe downturns in price as broader market suffered, but now looks pretty resilient in this price range - especially with everything else going on in the world at the moment.

xx) Incomplete Control - 100 in collection - current market cap approx. $13,300,000 ($133,000 x 100) (only 2 for sale and not huge amount of sales history to go on - so using 100E as a floor price).

Less well known. Less volume. Far fewer routine sellers suggest most holders buying to keep.

xxx) QQL

So what marketcap should QQL have?

To answer this we should probably consider why there exists such a large difference in the marketcaps of the Fidenza collection and the Incomplete Control collection?

The answer to this I believe lies in two truths: aesthetically the Fidenza is more appealing; and as a consequence it has penetrated the digital zeitgeist in a way few pieces manage. (A contributing factor is that it was launched at a time of heightened market excitement/speculation which created a fertile environment for high headline-making prices.)

So the question is: how firmly can QQL grip the mind of the digital collector?

The early signs I believe are strong. The collaboration process and Twitter competition (where outputs generated by the public were judged by DC Investor, Sofia Garcia and Emily Xie, and granted QQLs if selected as the best) had many participants spellbound by the beauty of the algorithm and investing their time into creating many, many outputs.

Based on nothing other than the pre-sale action, I would have placed the QQL marketcap inbetween the Fidenza and Incomplete Control marketcaps. (I had initially thought these had no chance of falling below 20E in the Dutch Auction.)

ii) Media - Nifty Portal / Proof

As part of the roadshow before a launch, the artists need to get the word out.

They hit some of my favourite platforms like the Nifty Portal and PROOF, where at scale people could learn about the project.

You can learn more here:

Nifty Portal - Node Mode

PROOF

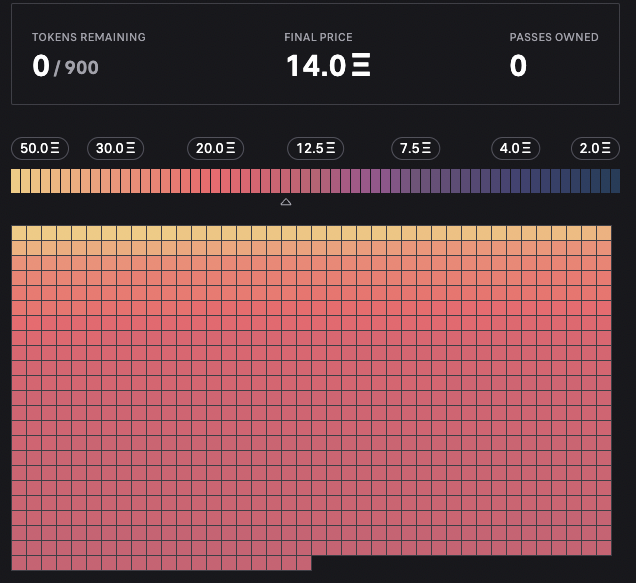

d) The sale - dutch auction with refunds

The dutch auction went flawlessly.

The price started at 50E and reduced over the course of one hour until all 900 mintpasses were sold.

The cool thing was that if you bought one at 35E, but the final price was 14E - which it was - you would get refunded the difference. So everyone paid the final, lowest price of 14E.

d) Post-sale action

i) Price

Price has risen from 14E to 17E.

The percentage listed for sale over the weekend had crept up to almost 10%. It was around 6% a couple of days ago. Perhaps a few people have been tempted out by the quick rise in price.

The unique ownership is at about 50%. That’s pretty good. With top collections like this many people like multiple pieces - especially since people might want to mint one and keep one as a mintpass in this scenario.

ii) Community reaction

Capturing attention is the key for something to become iconic.

Prominent people are enjoying the project.

Punk 6529 is working on his outputs.

DC Investor is looking forward to seeing more of the outputs, and was a judge in the process.

Von Mises interestingly paired his QQL with his Fidenza - it could be very interesting to see if this more thoughtful curation across collections takes hold for people.

iii) Conclusion

I have really enjoyed covering this project, seeing what others have produced, and playing with the algorithm myself.

As someone who is not an artist, but likes to think of themselves as an appreciator of art, it is really fun and empowering to (i) be included in the process and (ii) actually have the potential to produce something great and valuable.

The fact that the collector literally participates in the curation of the piece AND benefits financially from secondary royalties in perpetuity is powerful.

Ultimately, I believe the value of these will be determined by their aesthetics. And the slow release means there is no rush for a collector to mint their pass which should contribute to a more peaceful, thoughtful appreciation of the art (and price).

4. Thought of the Week

For most people, universities are a scam.

Though I do think certain professions absolutely require higher education, I am certain the current higher education model is flawed, bloated, and - worst of all - selling the majority of students a lie.

Most of the marketable skills in the world of the internet - which is the world the majority of people live in - do not require a degree.

I think of how the internet has scaled, and how crypto and NFTs are doing similar, and am more certain that very specific courses teaching very specific knowledge will be the way forward.

5. Meme of the Week

We love the threadors - shoutout @jordihays

Have a great week,

B

Please do leave me any questions or thoughts here - I respond to every one!

And if you thought this was interesting, please consider subscribing to this Substack here and following me @BCheque1 and @32dreams_ on Twitter for more on NFTs and Web 3.0.

Our long-form podcast discussions can be found on YouTube and Spotify.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters.