Paper 31: NFT Lending Liquidity Crisis

How we borrow and lend against illiquid JPEGs just to feel alive

Contents

NFT Lending Liquidity Crisis

This Week in NFT World

New Interview with VJ and Safa

Thought of the Week

Meme of the Week

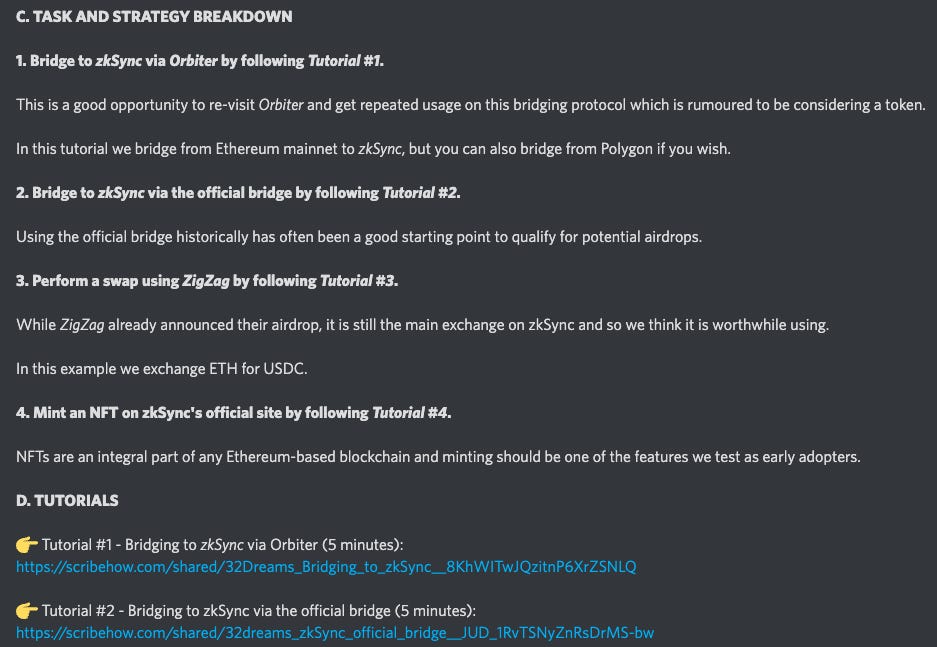

Before I start this week, a quick reminder on layer 2 airdrop opportunities.

THE OPPORTUNITY: Layer 2s (Arbitrum, Optimism, zkSync, Starknet) are important to help Ethereum become more affordable, and they are in competition with each other for your business. This is why the “decentralised model” appears to be: airdrop tokens to incentivise early participants (and have those people take a governance role in the future of the network).

THE PRODUCT: Although we cannot guarantee any airdrop from any protocol, at 32 Dreams we recognise the pattern of historical data and behaviour. We produce weekly tutorials so (i) you do not have to do endless research on Twitter and Discord; and (ii) you can more easily participate in the network and get some exposure to the potential upside via manageable tasks. More info on 32dreams.xyz

MINT: You can mint here for 0.16 ETH and join our private discord where we share our thinking, strategy breakdowns, and tutorials.

FREE TUTORIAL: So you can preview what we do, here is a free tutorial on how to use Orbiter Finance, a bridging protocol which currently does not have a token but who have hinted at one in the future.

Have a great week!

B

1. NFT Lending Liquidity Crisis

At one point in the last week there was 32,267 ETH ($59,048,610) worth of NFTs being used as collateral for loans on BendDAO - and some were in serious danger of liquidation.

In English, this means that a lot of loans were taken out against NFTs, and the value of those NFTs dropped so dramatically that the loans began to be considered “bad debt” (ie the lenders became uncertain that the value of the NFT would cover the debt owed to them).

With that uncertainty, the lenders need to “liquidate” the NFTs for the highest price possible to try to make sure they recoup their funds.

This is a live, ongoing issue which BendDAO is seeking to address.

Here is how it works and how the drama unfolded/is unfolding:

BendDAO allows you to take a loan out against certain “blue-chip” NFTs.

The maximum amount of ETH that can be borrowed against the NFT is 30% or 40% of the collection floor price on OpenSea, depending on the collection.

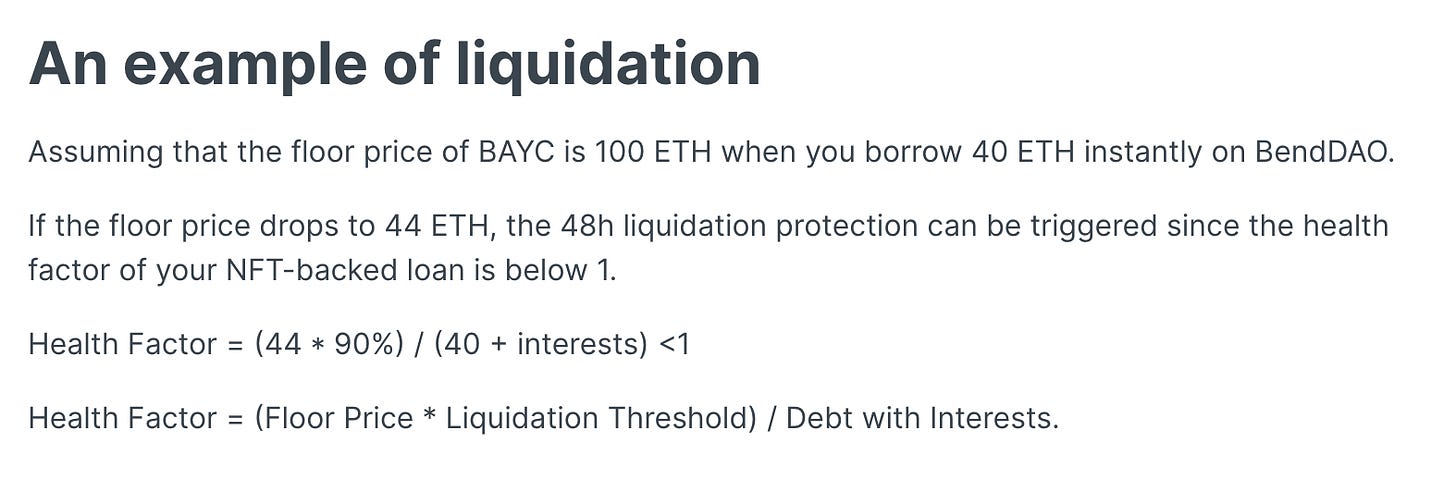

So for example, if the OpenSea floor price of a Bored Ape NFT was 100 ETH, you would be able to borrow 40 ETH instantly on BendDAO.

On the 40 ETH loan, you would obviously need to pay interest.

If the NFT floor price drops so low that the lenders are in danger of losing money on their loan a “health warning” is triggered. A health warning is triggered when the loan health factor goes below 1, which is calculated like this: (floor price * liquidation threshold) / Debt plus interests)

The health factor is basically just a number that represents the safety of the deposited NFT against the borrowed ETH.

When the health factor goes below 1, the NFT is put up for auction. Any bid is valid which is i) 95% of the OpenSea floor price; and (ii) above the debt the borrower owes, but the owner of the NFT has a 48 hour period as an additional opportunity to pay back their debt.

The problem was that some NFTs coming up for auction were not catching any bids because the floor price has been decreasing so consistently that buying at 95% of “true value” is not a sufficient discount for buyers to be tempted.

In addition, because so much ETH had been loaned out, and some borrowers were not paying their debt AND interested buyers were not bidding, lenders got worried that they might not see their deposited funds again so started a bank run on BendDAO. ($29,000,000 to $25,000 (!))

As money in the bank dried up, interest rates rose for existing borrowers, and this caused some repayments to replenish the bank (to a small extent)

BendDAO have now made an emergency proposal to the DAO to:

(i) adjust the liquidation threshold to 70% - this would mean that even some NFTs with a health factor above 1 would be liquidated, and so more NFTs would come to market. This is good for BendDAO because they won’t be waiting for the NFTs value to get so dangerously close to the value of debt owed before triggering liquidation.

(ii) adjust the auction period to 4 hours - this would mean a faster buying process so the bank can be replenished quicker

(iii) adjust interest base rate to 20% - this would incentivise ETH lenders to keep/deposit their money in the bank

(iv) the minimum starting bid to change to the value of the total debt (instead of it being linked to the floor price on OpenSea). This makes the NFT far more attractive to a potential buyer.

This is a bit of a heart-in-mouth period of time for ETH lenders.

Some NFT holders might also be concerned with the potential new supply of NFTs entering the market.

The general consensus is that the quantity of NFTs involved shouldn’t be too disruptive to price, but we watch closely to see how the protocol can operate in a smoother fashion and minimise risk to lenders appropriately.

Tune in next week to hear what happens next!

2. This Week in NFT World

BAYC reaches 1 million followers on Twitter - The Bored Ape Yacht Club held a commemorative Twitter Spaces to celebrate their growth to 1 million Twitter followers. More than 4,000 people attended live to reminisce on their journey thus far, and to date 28,000 people have tuned in subsequently.

Fewocious’ The Sailor sold for 350 ETH ($ value) to 6529 Capital- The Sailor, one of Fewocious’ most important pieces, has been bought from major “CryptoArt Protagonist” @2Yeahyeah for 350 ETH. At 19 Fewocious has already sold at Christie’s and Sotheby’s.

Tokengated virtual spaces coming this week - In response to Deeze’s question about how to tokengate a private video, it was revealed by oncyber that their tokengated rooms would be shipping soon. This allows for the possibility that certain NFT holders will be able to congregate in a particular room to consume content exclusively.

We spoke about all of this and more in this week’s episode #15 of NFT World.

3. New Interview

VJ (@valetjones) and Safa (@seeapefollowape) are the founders of Tally Labs (@TallyLabsNFT), the company under which Jenkins The Valet (@jenkinsthevalet) and Azurbala (@azurbala) are being built.

They are at the forefront of giving people the power to turn their IP into characters in the web3 space - and have managed to successfully build a patient and supportive community in a notoriously impatient and demanding space.

In this chat we discuss

- how their backgrounds prepared them for success in web3

- the lightbulb moment on commercial rights and "worldbuilding"

- how to build a patient and supportive community

- how to switch from an "nft project" to an "nft business"

4. Thought of the Week

Compliment people more, with no expectation. Maybe nothing comes of it in future; maybe something does.

Either way, it can’t be a bad thing that you tell somebody sincerely that something about them came across as very impressive.

As a founder in the web3 space, I have found relationship building to be heavily reliant on Twitter and Discord.

Interacting online can be impersonal at times and can make us impatient.

I liked the idea that Nick Dio suggests: make communication less transactional and more sincere by reaching out to people who are mentioned to you in a positive light to let them know.

Everyone likes a shoutout.

5. Meme of the Week

Everyone has been this hero at some point. Then you grow up, get married, and have children - and mint from a burner wallet. Shoutout @alexjmingolla

Have a great week,

B

Please do leave me any questions or thoughts here - I respond to every one!

And if you thought this was interesting, please consider subscribing to this Substack here and following me @BCheque1 and @32dreams_ on Twitter for more on NFTs and Web 3.0.

Our long-form podcast discussions can be found on YouTube and Spotify.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters.