Preface: There is a part of your soul which is trapped in an unsold NFT which is purchased with this strategy. Be wise and mindful.

Today’s Paper is a story.

A story of how a friend and I turned $450 into a collection of 14 NFTs valued at approximately $16,000 with a couple of thousand spare in the bank - in 3 months.

Whilst this is by no means a colossal collection or demonstrative of other-wordly gains (this collection is meant to be a fun side-project with a friend), the thought process which we followed to achieve this represents a manageable framework for any industrious person to participate in the exciting market of NFT collecting.

This story is about money, preparation, teamwork, execution, and luck.

It will not appeal to the idealists; it doesn’t even really appeal to me. In reality, however, art and money are inexorably connected.

Telling this story, I hope, can provide some people with greater freedom to collect what they love most. (Though please note this is a recollection of the past; not a definitive prediction of the future. Markets change quickly.)

This story begins with us discovering the Feral File platform a few months ago. That is when this NFT collection began.

(A) Research

(i) Platform

I considered the following factors when assessing Feral File:

Reputation / Creators - does the platform have a long-standing reputation OR is it created by known artists/curators?

Casey Reas - Feral File’s creator - is a highly respected generative artist. All sorts of published work; clear engagement and well-regarded by peers; and ‘blockchain art legends’ like Artnome are curating on Feral File.

Blockchain - on top of which blockchain does the platform run?

Bitmark - this was a problem for me as I prefer to deal on Ethereum.

Ethereum has become the default blockchain for NFTs - at least for “premium” ones. Other blockchains exist and facilitate the buying and selling of NFTs e.g. Tezos, Flow, Solana.

Feral File has built bridges for their NFTs so they can be migrated to the Ethereum network. Because of these bridges - and because of the sales activity point made below - I was not put off from buying on Feral File just because it was on Bitmark.

(Next week’s Paper is going to look at the pros and cons of different blockchains.)

Artists - does the platform attract ‘high profile’ artists?

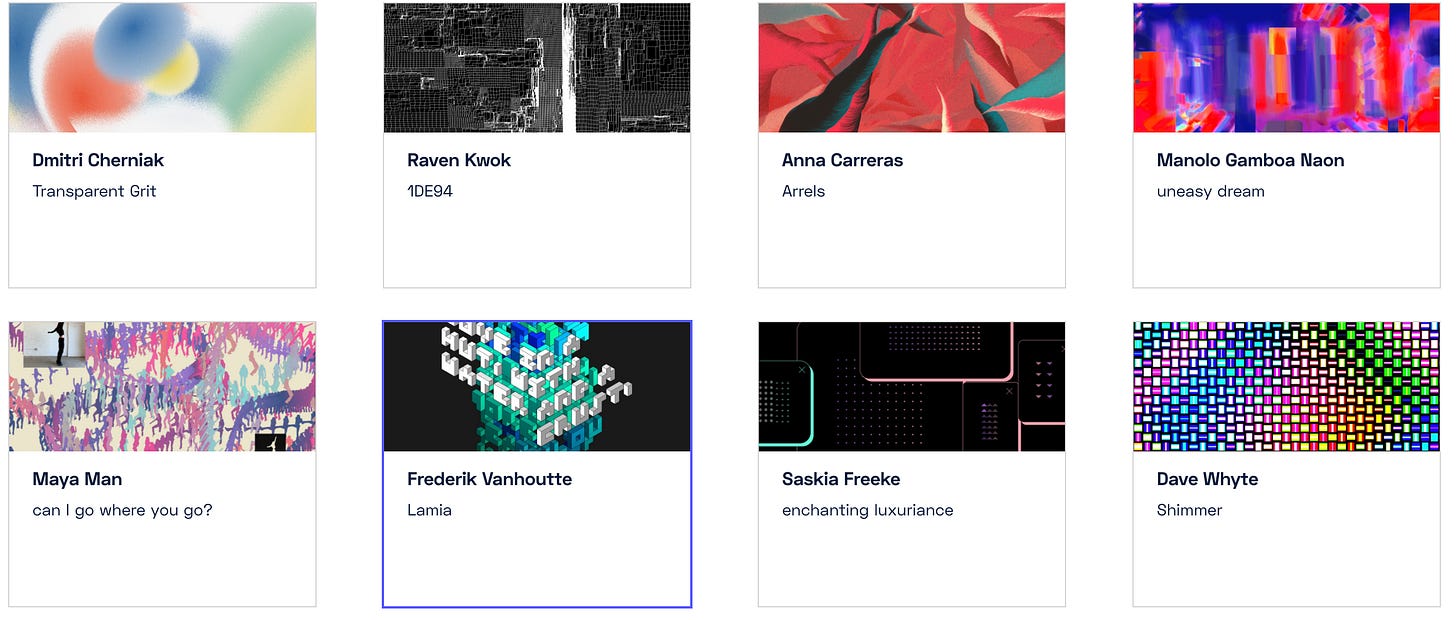

Feral File has attracted some of the most acclaimed artists in this space. I immediately recognised Anna Carreras, Frederik Vanhoutte, and Dmitri Cherniak as I browsed previous exhibitions.

Volume / Sales Activity - how often - and for how much - are resales made and when do they take place?

The secondary sales market seemed healthy - though not unanimously. Most activity seemed to take place straight after a drop. It was clear on this platform that, whilst I considered all of the art to be beautiful and well-curated, not all '“performed” equally. Thus, there was an opportunity for a knowledgeable collector to buy piece X for the same price as piece Y, even though piece X was reliably more valuable than piece Y.

(ii) Artists & the Art

How did I decide from which artist to buy? This was my first Feral File exhibition.

Twitter - I first went to Twitter to see how many followers the artists had AND what sort of content they put out AND what sort of engagement they received AND if there were any other artists/collectors who I respect following them.

SuperRare / Foundation / Opensea Profiles - From an artist’s Twitter account you can usually find their official artist pages on other established platforms. When I found those platforms, I looked at for how long they have produced art AND for what price that art was sold AND if there was an uptrend or downtrend in the price of sales AND who was collecting that art (some collectors are more well-known than others).

For example, I liked that @kevinrose was a collector of Nicolas Sassoon, and @Cryptopathic and @batsoupyum were collectors of ertdfgcvb.

The Art - I used my eyes to see what I enjoyed.

Price and Supply - It’s important to consider the primary sale price relative to other sales by the artist.

For example:

These Feral File pieces were editions of 30 and were priced at $450. That is a market cap of $13,500.

In order to “test” this primary sale price, you should be able to see that the artist can reliably sell 1/1s at or around that price.

If the market cap of editions is significantly less than the price of a 1/1, that *should* be an indicator that there is upside potential for the edition.

*Oftentimes editions will trade at a higher market cap than a 1/1 because they represent the most accessible entry point to a successful artist’s work.*

After conducting this research, I was considering Nicolas Sassoon and ertdfgcvb.

(iii) Process of buying

It is essential to understand the buying process when dealing with desirable scarce assets. These items will be gone in seconds. It’s important to consider the following:

How can I pay? Credit card? USDC? ETH?

Do I need to have funds in my account in advance? If yes, how far in advance?

Are there any conditions for buying? (E.g. is a particular drop for collectors only?)

What are the mechanics of the drop? Can you just buy one at a time? Can you buy multiple? Is there a bidding system?

When the drop time comes do you have to refresh the page? Or does it automatically refresh?

Are there transaction fees? If there are, is there anything you can do to speed up your transaction to make sure you secure the asset?

For Feral File, I was reassured a credit card payment would be fine. I didn’t need to have funds in my account in advance. There were no conditions for purchase but I could only buy one per transaction. There was no worry about speeding up transactions - once you got through to the credit card page, you were guaranteed purchase so long as you completed payment details within a set time limit.

(B) Buying

Have a plan. And execute. I planned to go for the Sassoon, and my friend would go for the ertdfgcvb piece.

Because of excessive demand, I did not manage to get the Sassoon piece, but my friend secured the ertdfgcvb piece for $450.

(If there are transactions costs involved, make sure you are in control of them and aren’t wrecking yourself - another Paper is going to deal with how best to optimise your chances in gas wars.)

(C) Selling

Timing and pricing is everything.

(i) Timing

On Feral File it appears that most secondary market activity takes place in a window straight after the primary sale.

As such, it was important for us to try to sell this piece as soon as possible. (We also wanted to build a collection without injecting more capital, so we had to sell.)

But at what price?

(ii) Pricing

ertdfgcvb appeared to selling 1/1s between $8,000 - $10,000 on SuperRare.

An edition (1/30) might be valued at around $333 to achieve a $10,000 market cap. However, as already mentioned, editions will trade above market cap. (Also, $333 is just way too cheap for a quality piece of art in this space.)

I considered a $3,000 approximate price a sufficient discount to a 1/1 that would entice a collector.

But then we saw a $7,000 sale go through.

We immediately listed at $7,777.

A moment later - sold.

There was not another sale for another three months.

Was this luck or skill?

Both.

(D) Re-investing

The process largely repeats itself. But when you buy on secondary markets there are other factors to consider:

Are there any benefits for collecting a whole set?

Are there any burn mechanics to reduce supply?

Is there any upcoming whitelist/giveaway opportunities?

Are there any future exciting collaborations?

Has the artist appeared at or are they likely to appear at Christie’s or Sotheby’s?

In consideration of the above, we reinvested in:

Brendan Dawes, Arcade Machine Dreams: Tractor Beam (bought $1950 - holding)

Fewocious, Victor and Victoria (bought $2,299 - holding)

A full set The Bardo: Unpacking the Real (bought $1,050 - holding)

Refik Anadol, Unsupervised — Data Universe — MoMA (bought 3 @ $100 each - sold 2 @ approx $800 each)

Trevor Jones, Superhero - Bronze (bought $2,000 - sold $6,777)

Osinachi, Heartbeat (bought $999 - holding)

Osinachi, Lost (bought $1,555 - sold $2,750)

Helena Sarin, Leaves of Manifold (bought $222 - holding)

Jasti, Discovery (bought 2 @ $500 - sold 1 @ $1,099)

Pak, Merge (bought $4,000 - holding)

We have approx. $2,000 in the bank.

In summary:

research a platform’s credentials

understand how / when the platforms makes most of its secondary sales

be confident on an artist’s credentials/potential

understand the exact mechanics of a drop, and how pricing relates to supply

understand the process of buying so you are prepared

execute your buy and be mindful of transaction costs

sell at the most appropriate time and for a “reasonable” price (always easier to sell into demand than undercut as demand disappears).

Closing thought

The market has been enormously helpful this year.

On some level I am uncertain that it can be so straightforward in future, but at the same time the very nature of NFTs by particular creators - digitally native AND scarce - means that demand should continue to outstrip supply (for those particular creators/assets).

Thank you so much for reading in 2021. I can’t wait to continue learning and developing with you in 2022.

Happy New Year!

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters.