#85 Future Income Loans: Unlocking Future Liquidity

How to get hold of money you have not yet earned

GM - this is The Snapshot, edition #85.

Welcome to the new subscribers this week - we are now at 2,014 subscribers!

I write about NFTs/crypto, and solopreneurship in web3.

This is what I’ve got for you this week:

This Week In NFT/Crypto World - Triumph for crypto; NFT SEC disaster

Sponsored Post - Lil Nouns Approves $34,000 Twitter Spaces Proposal

Notable Sales - Sam Spratt, Cath Simard, CryptoPunks

Thought Piece - Future Income Loans: Unlocking Future Liquidity

For sponsorship enquires, please DM me on Twitter.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

Have a great day,

B

This Week In NFT/Crypto World - Triumph for crypto; NFT SEC disaster

Triumph for Grayscale in BTC battle with SEC

This week Grayscale triumphed over the SEC in a big decision for cryptocurrencies because it paves the way for BTC ETFs.

The SEC had rejected Grayscale’s application for an ETF, but the Court has ordered that it must re-review Grayscale’s proposal.

Why is this so important?

An ETF for Bitcoin makes it a much more easily investible asset class as anyone will be able to get exposure to Bitcoin without having to literally buy it and hold it in their own wallet (a process which is painful for retail and institutions as things stand).

What is more: huge financial institutions like Blackrock are also awaiting decisions on their ETF applications. The big players are ready - and this is an indication that we are trending towards ETF acceptance: price rose 6% on this news!

SEC strikes down NFT project for violation of securities laws

Tom Bilyeu's "Impact Theory" NFT project was hit with a huge $6.1M fine by the SEC for the offering of unregistered securities.

They will also need to create a "Fair Fund" for investor reimbursement, destroy all Founder's Keys NFTs, abolish royalties, and circulate notices about the order on its digital platforms and social media.

The project amassed $30 million from October to December 2021 by selling NFTs under three categories of Founder's Keys: "Legendary," "Heroic," and "Relentless."

This will leave many NFT projects trembling. Why?

Because many projects made similar lofty - ultimately illegal - promises about the nature of an NFT “investment”.

In this case, the SEC asserted that the project persuaded investors to perceive the NFT purchases as business investments, backed by statements from the team about "building the next Disney" and delivering "tremendous value" to holders.

Key learning for founders: do not get caught in the hype and promise financial gains!

Chimpers go physical with premium figurine release

Toylaxy Studio is joining forces with Chimpers to release the first premium Chimpers figurine collection, featuring three unique collectibles inspired by the character, Master Chimpo.

This follows hot on the heels of Pudgy Penguins toy sales and the Doodles x Crocs collaboration.

This is another example of how brand is being almost entirely built on social media/in web3 first, after which IRL goods and experiences can be sold.

After working closely with the Chimpers team I am excited to see them extend their IP further - and have a big announcement on that soon!

Refik Anadol’s latest collection surges 5x from mint price

Refik Anadol’s Winds of Yawanawa collection minted at $2.5k not longer than two months ago and has since surged to almost $12,000.

Refik has established himself as one of the finest digital data artists in the space. He has collaborated with SpaceX and currently has an exhibition with the MoMa in New York.

This Winds collection is a co-creation with the Brazilian Indigenous Yawanawa community, made with the intention of highlighting the nuances of Yawanawa art and preserving the community’s rich culture.

As always: the finest of digital art continues to thrive.

Sponsored Post - Lil Nouns Approves $34,000 Twitter Spaces Proposal

I wrote a couple of weeks ago that Lil Nouns had declined to fund the The Lil Nouns Show - that has changed!

A key voter was missing - and after gathering their thoughts and making some changes - the team resubmitted their proposal to secure $34,000 of funding to produce another season of its live Twitter Spaces.

The Lil Nouns Show was the most listened to weekly Twitter Spaces show in the Nouns ecosystem, achieving 13,100 listeners across 36 shows.

Congrats to the team! Another shining example of how Lil Nouns DAO is still open for business for talented and committed builders.

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life:

Check out the latest proposals for more details or reply to this email with any questions you’d like me to answer.

Notable Sales - Sam Spratt, Cath Simard, CryptoPunks

Sam Spratt, Skulls of Luci - 90 ETH ($148,500)

Cath Simard, I Found You - 31 ETH ($51,000)

CryptoPunk, Buck Teeth - 67 ETH ($115,000)

CryptoPunk, Pipe - 58 ETH ($99,600)

CryptoPunk, Cap Forward - 69 ETH ($118,000)

CryptoPunk, Police Cap - 59.7 ETH ($102,000)

Thought Piece - Future Income Loans: Unlocking Future Liquidity

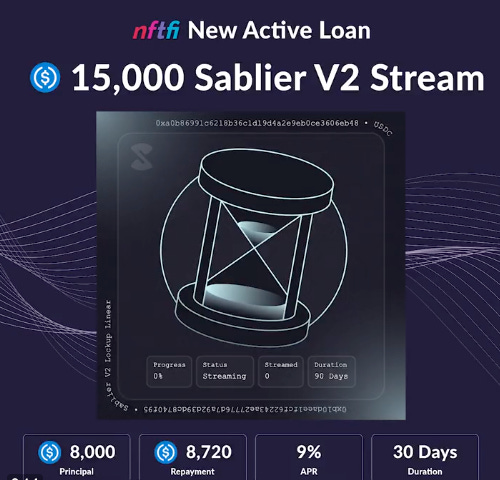

You can now take a loan out against a future income stream via an NFT.

Let me explain.

Using the NFTfi protocol, a borrower was able to secure an 8,000 USDC loan at 9% APR over 30 days against a 15,000 USDC 90-day token stream. This means the borrower accessed 53% of their future income upfront - which is pretty cool!

Where does the NFT come in?

Once a stream is set up on Sablier - a protocol for streaming money to people over time - money starts accruing to the recipient, but to take custody of the funds you actually have to execute an on-chain transaction.

The NFT represents the key to that future streams of tokens, because it is only the owner of the NFT who can unlock the streamed funds.

As such, the borrower cannot access the funds until the loan is repaid (because they do not have custody of the NFT which is held in escrow); and in the event of default, the NFT transfers to the lender who can then access the accrued funds as well as enjoy the benefit of the rest of the stream of income.

There are three ways this could be super useful in future:

Payroll Flexibility: Employees can receive advance liquidity by borrowing against their future on-chain income. This eliminates the need for banks and credit scores, providing instant access to frictionless, permissionless, and global liquidity.

Leveraging Airdrops: Airdrop recipients can use airdrop streams as collateral, creating immediate utility for the token and attracting liquidity to their ecosystem.

Token Vesting Liquidity: Venture capitalists, advisors, and core project contributors can unlock some liquidity upfront while their tokens are still vesting.

I have written about NFT lending a great deal. This is another example of how NFT Lending will usher in a new age of finance.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters