GM - this is The Snapshot, edition #123.

This is what I’ve got for you this week.

This Week In NFT World - CryptoPunks revolt; dying token models

Notable Sales - CryptoPunks, BAYC

Investor Focus - ETH ETF Approved: The Bull Case

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World -

CryptoPunks revolt as Nina Chanel art is rejected

This week famous artist Nina Chanel’s 500 piece collection Super Punk World was presented to CryptoPunk holders as an opportunity to collect - and most of them were not happy.

While some people defended the collection, arguing that it was created by a well-recognized mainstream artist and would offer beneficial new exposure to CryptoPunks, many others wished that Yuga Labs (who own the CryptoPunks IP) would refrain from playing around with the IP. They believe it should remain unchanged to preserve its value.

I kind of think that Picasso himself would not have pleased Punk holders. Because it’s not about the art or the artist: it’s about the guarantee that the stewards do not do anything.

Doing something sets a precedent, which means it’s possible to do something again (+ again) which means a variety of things to analyse, debate and argue over - and people do not want to debate something they consider stamped into blockchain history.

I don’t strictly think it’s true that people really want Yuga to do nothing. A book was fine. Other cool posters were fine. It seems like some combination of exploring a ‘woke’ message + the company trying to monetise CryptoPunks made holders think this was a dangerous precedent and bad stewardship.

So much so that CEO Garga changed course to make the collection only available for existing Nina collectors + admitted Yuga would “no longer touch punks”.

Mocaverse moves up 50% on tokenomics reveal

Mocaverse ripped up almost 50% this week from 2.6 ETH to 3.9 ETH because of its tokenomics reveal.

The NFTs themselves will receive 10% of the whole token allocation (estimated to be a multi $B FDV). But they will not receive all of that right away:

1/3 at TGE

1/3 after 3 month cliff with 12 months vesting

1/3 future incentives

At a $2B FDV, 10% of this is $200M, 1/3 would be $66.6M, divided by 8,888 holders, that would be $7.5k for each holder.

The big assumption is the FDV: the rest of the calculations rest on that.

I think we see a loss in value post airdrop around 1-1.5 ETH which eats a lot into that airdrop value - but then the question is do you think the effective yield of another 2/3 of $MOCA is worth locking up your ETH in the NFT for at least a year.

Right now I prefer liquidity.

Cobie publishes article on low float, high FDV tokens: more value is captured on private markets

Talking of tokens, you have to read this article by legendary trader and crypto thinker Cobie on new token launches and low float, high FDV tokens.

Here are four key learnings:

Private Market Dynamics and Price Discovery: Most of the price discovery for new tokens now occurs in private markets before the tokens are publicly available. This means that early price increases are captured by private investors, making it difficult for public investors to benefit from significant price appreciation. This shift has led to inflated valuations and less favorable returns for public market participants.

High Fully Diluted Valuations (FDVs): High FDVs for new tokens are now common due to increased market demand and more capital in the space. However, not all high FDVs are justified. Investors need to evaluate whether these valuations reflect genuine market demand or are artificially inflated by private market dynamics and strategic actor manipulations.

Issues with Low Float Tokens: Low float tokens, where a small percentage of the total supply is in circulation, can lead to significant market distortions. While not inherently bad, low floats combined with high FDVs and other manipulative practices can create misleading valuations and increase the risk of significant price drops when tokens unlock.

The Importance of Evaluating Tokenomics: Investors should carefully research the tokenomics of new launches, including the valuation, unlock schedule, and distribution of tokens among private and public investors. Understanding who holds the supply, the terms of their holdings, and the actual float is crucial to making informed investment decisions. Opting out of overvalued token launches and being patient for better opportunities is advised.

He seems to reminisce on how there was certainly a more democratic aspect to ICOs (initial coin offerings) in years gone by, where public investment had the potential to return huge amounts. Unfortunately, these are mostly illegal now (lol) but to be fair it did attract an insane amount of rogue people who could raise quickly and disappear.

Basically it’s horrible to keep looking at a chart that keeps going down because of unending sell pressure: the ICOs allowed chart to actually go up (if it was successful).

Trump campaign accepts crypto and FIT 21 passes

Crypto got extra political this week as Trump began to accept crypto donations - but more importantly FIT 21 (Financial Innovation and Technology for the 21st Century Act) was passed this week.

The bill aims to establish a comprehensive regulatory framework for digital assets, addressing an obviously longstanding regulatory gap in the U.S.

This is a pretty huge step change for the US. Along with the ETH ETF news (read on for that below) it seems like the authorities are capitulating for crypto.

Twitter competitor Farcaster raises $150m

Decentralized social network Farcaster secured $150 million in a Series A funding round, bringing its valuation to $1 billion. The round was spearheaded by Paradigm, with additional investments from a16z Crypto, Haun Ventures, Union Square Ventures, Variant Fund, and Standard Crypto. The platform has 80,000 daily active users.

Whilst that is great progress - feels like a very high valuation for how many active users they have.

Some of the hype around the platform has died down since the $DEGEN token has died down. It was a token that was distributed for free to active users, and it became worth a lot, and people could give it out to each other (casually handing out thousands of dollars at a time) - only in crypto….

Notable Sales - CryptoPunks, BAYC

CryptoPunk, VR - 47.69 ETH

BAYC, Tie Dye - 18.99 ETH

CryptoPunk, Purple Hair - 38.5 ETH

CryptoPunk, VR - 52 ETH

Investor Focus - ETH ETF Approved: The Bull Case

the best tweet for the midcurvers on the eth etf adapted from famous good will hunting scene

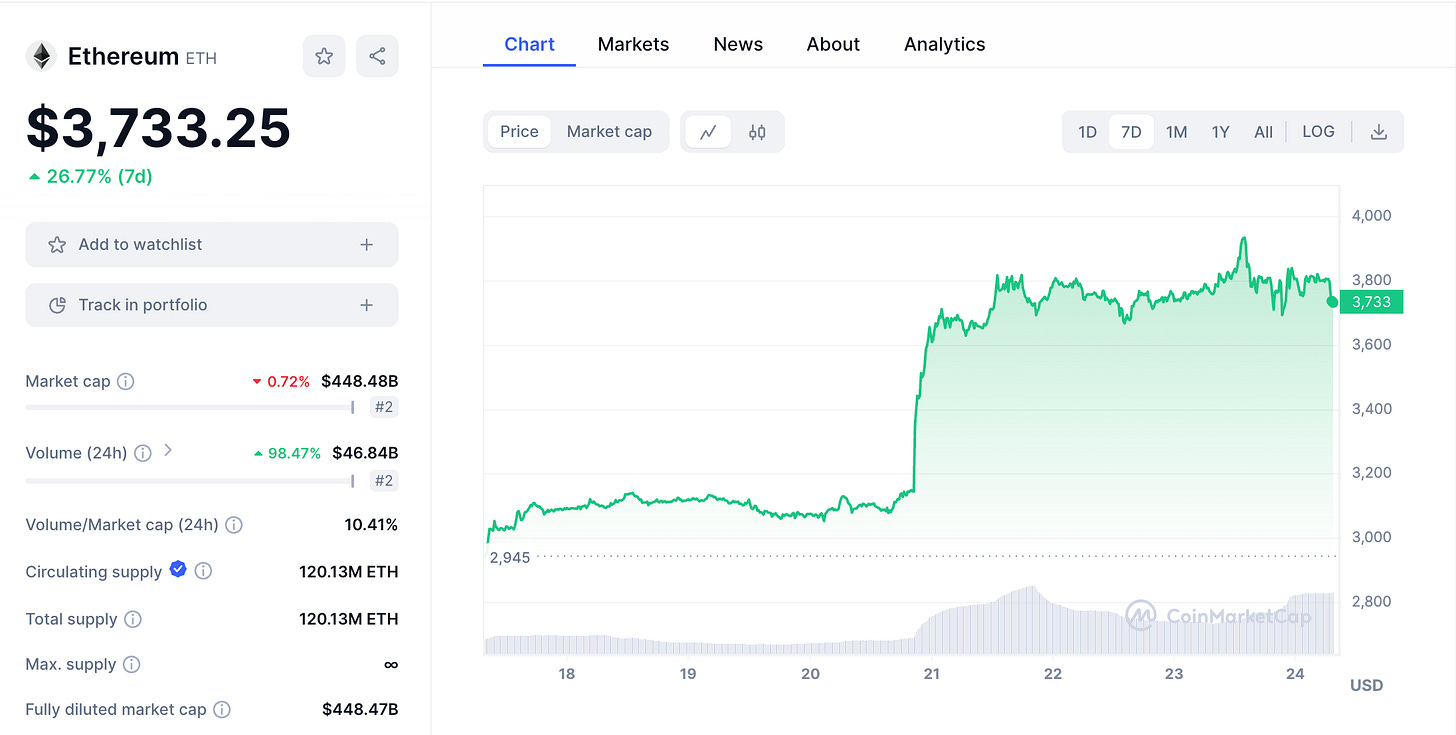

ETH maxis rejoiced this week as the ETH ETF - the belittled sibling of the BTC ETF for which noone had any hope of acceptance - was all of a sudden approved by the SEC.

You can see when people realised it was going to get accepted after this tweet from our favourite Bloomberg ETF reporters.

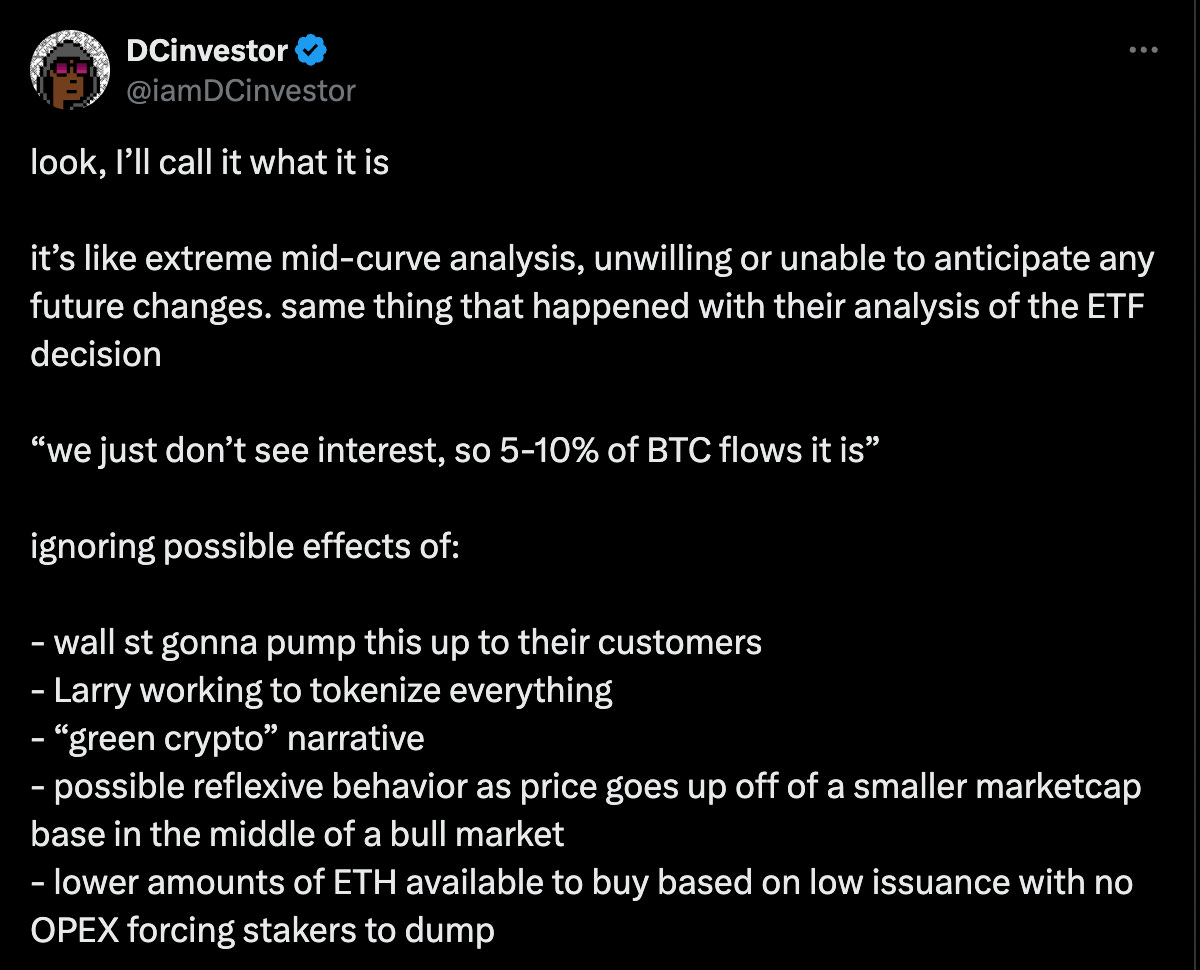

Why did the experts get it so wrong that they needed to revise their % chance of approval up from 25% to 75%?

It appears that they genuinely were kept in the dark about the approval.

This meant the market really was not pricing in approval - as was demonstrated by the sharp move on Polymarket, where you can bet on the outcome of irl things.

Now that it is approved - now what?

We seem to have everyone on the timeline arguing: what if it underwhelms because it has much less demand than BTC? is it good but it’d be better to buy ETH beta? will the SOL ETF be next so that is the best next buy?

Tbh i think it depends on your timeframe and risk profile. Some people are absolutely obsessed with going further down the risk curve and want the next play so that they can maximise the amount a token goes up.

Personally I find ETH so useful (can stake it, restake it, use it for NFT lending against high quality digital assets, earn Blast Gold, farm various protocols) that I try to maximise the amount of ETH which I can earn.

I could be wrong but I cannot see a universe where it ends up being bad for ETH that ETH now has an ETF.

No that doesn’t mean the price will necessarily go up vertically immediately. Even BTC experienced a healthy sell-off in the immediate aftermath of its own ETF.

But the fact that wall street’s incentives are aligned now, Larry Fink wants to tokenise everything on ETH, and ETH’s token design under proof of stake creates such a low issuance, it feels like ETH is very well placed to be the “decentralised fintech stack”

On some level I think eth represents economic activity, whilst btc represents digital gold. In the real world, economic activity trumps gold. Something to think about…

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters