Paper 68: Burning a million; printing of trillions

Why Balaji burned $1M to raise the alarm on the banking system

GM - this is the BCheque Papers, edition #68.

Welcome to the new subscribers this week - we are at 1,807 subscribers now!

I write about NFTs/crypto, and trying to make it independently in web3.

This is what we’ve got this week:

This Week In NFT/Crypto World - Burning a million; printing of trillions

Sponsored Post - Chimpers

Notable Sales - XCOPY; DeGods; Sam Spratt; Dmitri Cherniak

NFT Lending - BLEND surges to top of Buy-Now-Pay-Later market

For sponsorship enquires, please DM me on Twitter.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

Have a great day,

B

This Week In NFT/Crypto World - Burning a million; printing of trillions

This week US banks were collapsing everywhere and meme coins went absolutely crazy wild UP (and multiple scam coins were launched and went to 0). A quiet week then!

The market and outlook is carnage right now to be honest.

You can barely make a transaction on Ethereum because gas is so expensive from everyone trading these shitcoins so aggressively…

Daniel about to give up to go play soccer for the summer

Balaji “burned a million to tell you they are printing trillions”

The full video explanation by Balaji

Balaji bet some time ago that BTC would hit $1M in a few months.

He has paid this bet out early - and claimed that he essentially ‘burned’ that money to make people aware of the dire situation in the American banking system so they have a chance to get out.

His video is worth watching.

In essence his message is: the majority of banks are insolvent; other sectors are breaking too (insurance; commercial real estate); the media (and everyone else involved) will lie to you and keep telling you it is fine until it isn’t.

He ends: “if you are trading, being early is the same as being wrong. But if you are preparing hell is truth seen too late.”

US banks are collapsing

On that note, some American banks continue to fall.

At the start of the week First Republic was taken over by JP Morgan.

First Republic collapses into the hands of JP Morgan

And later in the week we have many others in precarious positions.

Balaji puts forward an interesting reading of the situation which is that this is an opaque nationalisation of the banking system.

Balaji on bank nationalisation

I am persuaded by all of this, though I recognise I am by no means an expert on this topic (and there are just so many factors for us to get our heads around).

The tone has certainly become more alarmist recently (and that has coincided with various bank failures.)

I think it’s time for that good old DYOR and assess your own risk.

Or have a little fun with the meme coins…?

Meme coins UP

I wrote about $PEPE two weeks ago.

It has continued to go up (a lot!)

So much so I will just leave this here for you to think about (!)

Scam coins DOWN

Some opportunistic members of the Wall Street Bets team decided to drop a coin to take advantage of this “meme coin season”.

It was promptly rugged by one of the members who had a lot of the supply, who cashed out $635k before it even really had a chance to get started.

As I said, this is a savage market right now.

The wild profits are bringing out the grifters.

Have fun; take care.

Sponsored Post - Chimpers

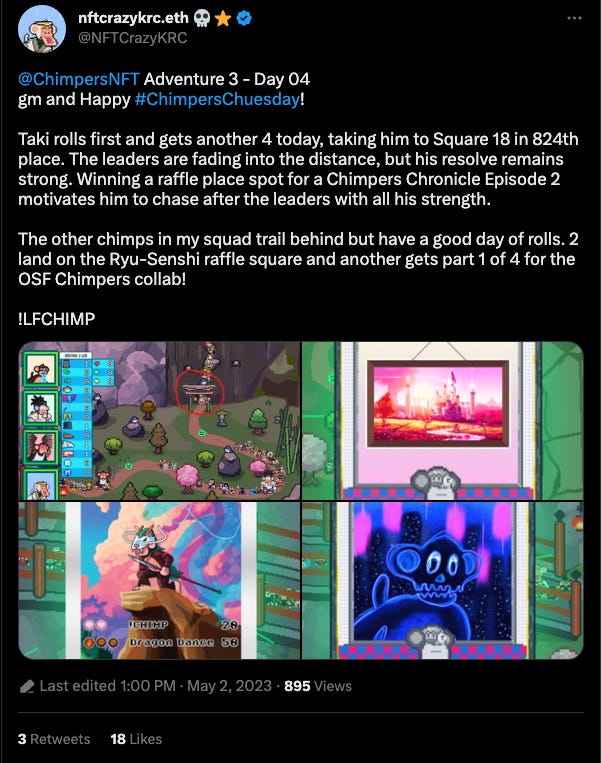

Whilst most NFT projects are “building” a game, the Chimpers team have just shipped their 3rd - that’s right - 3rd game!

Adventure 3 is a proper blockchain board-game which has me logging in every day to roll my dice.

With each roll the Chimpers explore the moonlit peaks of the mountainous region - the 3rd map released by the team - as they try to roll the highest number to speed across the map (snakes-and-ladders style!)

The game includes fun prizes which act as boosts and devilish pitfalls which send you hurtling backwards. The chimps take their progress very seriously!

What’s the aim of the game?

If you get to the final dojo first, you will be in store for a wealth of prizes like Chimpers Chronicles artwork editions, rare physical trading cards, AND guest art from the amazing artist OSF!

But there are all sorts of delights to collect on the journey too. Here we have two awesome community members, @silenth0dler and @mopo680, posting their Ws: legendary trading cards and guest art by OSF!

If you don’t want to miss out on Adventure 3 - with more rewards, great prizes and tons of fun promised - check out the Chimpers Discord to see how you can jump in with us!

Notable Sales - XCOPY; DeGods; Sam Spratt; Dmitri Cherniak

XCOPY, D I S O R D E R - 196.15 ETH ($359,776.37)

Medusa @DeGodsNFT huge sale 70 ETH ($132,800)

The Eye of Exodus - 62 ETH ($113,539)

Dmitri Cherniak Ringers #64 sold by Deeze collected by GFunk 45.52 ETH ($83,600)

NFT Lending - BLEND does the most Buy-Now-Pay-Later volume

BLEND is the new product launched by Blur, the biggest NFT marketplace, which allows people to buy NFTs via loans.

This tech is super important to bring greater liquidity to the market.

In this piece I will summarise:

i) What are the different types of NFT protocols?

ii) What is the BLEND value prop and how is it different to what exists now?

iii) What are the takeaways for this new tech?

In essence this piece is a summary of this thread by the brilliant and experienced lender Cirrus, who has made more than 8 figures worth of NFT backed loans.

Let’s go!

i) What are the different types of NFT protocols?

NFT lending protocols are a new form of lending that have gained traction over the last year.

There are two main types of protocols:

x) peer-to-peer lending; and

xx) peer-to-pool lending.

In peer-to-peer lending, borrowers list NFTs they want to use as collateral. Lenders can then place an offer specifying how much, how long, and the rate that they are willing to lend for. The main benefit of this model is the customisable terms and Loan to Value (LTV), which can be higher for rarer NFTs.

On the other hand, in peer-to-pool lending, lenders deposit their ETH into a pool that earns a variable APR, while borrowers can get access to that liquidity by depositing their NFTs and borrowing a predetermined amount, usually around 50-60% LTV. The main benefit of this model is that lenders can at any time withdraw their ETH and collect interest, whilst borrowers can get instant liquidity and also repay at anytime.

ii) What is the BLEND value prop and how is it different to what exists now?

BLEND is a new NFT lending platform that combines the flexibility of peer-to-peer lending with the fluidity of peer-to-pool lending.

It offers perpetual terms with no oracle-based liquidations and refinancing via auctions.

Lenders can give peer-to-peer loans and exit the position at any time by triggering a "Refinancing Auction".

If a new lender steps in, they pay off the initial lender and take over the loan at the interest rate that the dutch auction ended at.

If no new lender steps in and the borrower doesn't pay off by the end of the 30-hour auction, the original lender can claim the collateral.

iii) What are the takeaways for this new tech?

Here I will just quote Cirrus, whose perspective as a huge lender is much more important than mine:

“I think this new system + the fact that Blur is likely to incentivise loan offers is a huge benefit to borrowers and a huge hit to lenders. If you want to lend you are likely going to need to offer extremely favourable (and in turn risky) terms to compete”

“Blend is launching with collection offers only, so if you want to borrow against non-floor NFTs you're better off using other Peer-to-Peer platforms to capture higher LTVS”

“I think it’s good until its bad. The main thing that worries me is the incentives to give and take loans. To start, borrowers are likely going to capitalize on rates that will probably be the best they've ever been, leading to a leverage-fueled run in NFTs”

“But the cascades will likely get ugly... The incentives are bound to draw in many first-time lenders who give dangerously high LTVs and won't realize it until prices take a turn”

My take is that this is brilliant tech and Blur are really pushing the boundaries to unlock liquidity.

After a couple of days, it seems like things have settled down and people are not behaving too irresponsibly with these loans.

Let’s see how things progress!

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters