GM - this is The Snapshot, edition #158.

This is what I’ve got for you this week.

This Week In Web3 - Bybit hacked for $1.5B in largest heist ever

Sponsored Post - Nounish Cup Receives $500 for DOTA prizepool

Notable Sales - Punks, Bears, Penguins

Investment Focus - The $5M Masquerade by Sam Spratt

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - Bybit hacked for $1.5B in largest heist ever

Major cryptocurrency exchange Bybit has seen total outflows of over $5.5 billion after it suffered a near $1.5 billion hack that saw hackers, believed to be from North Korea’s Lazarus Group, drain its ether cold wallet.

The total assets tracked on wallets associated with the exchange plunged from around $16.9 billion to $11.2 billion at the time of writing, according to data from DeFiLlama. The exchange is now looking to understand exactly what happened.

From Coindesk

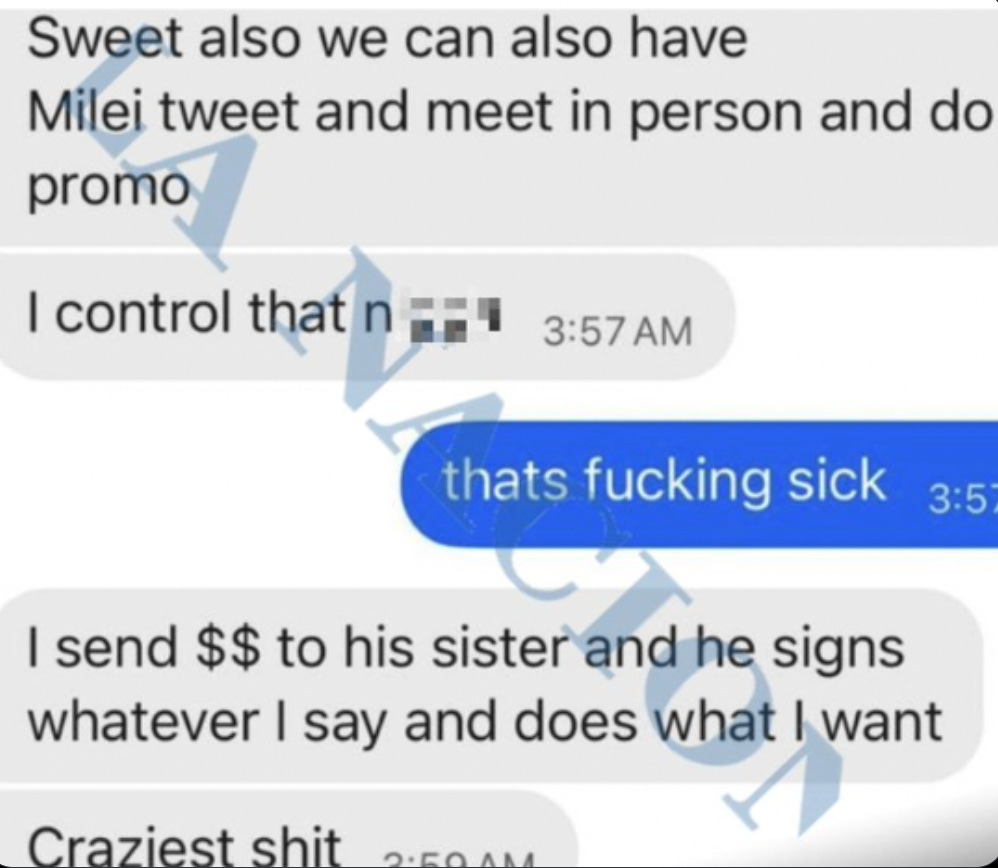

"Local media also report that Hayden Davis has kept in contact with Milei’s team to manage the scandal The conversations included a promise that Milei wouldn’t accuse him of wrongdoing and plans to send an envoy to meet him this week They also told him to stop doing interviews"

"Local media have now published the messages in question Conversation between Hayden Davis and an exec at an unnamed crypto firm, where Davis was seeking funding for the Libra launch. They declined."

Bitcoin rewards app Fold went public yesterday via SPAC merger with NASDAQ listed company

"Fold is now trading on Nasdaq under $FLD. A bitcoin financial services company built by bitcoiners for bitcoiners with over 1,000 bitcoin in treasury. LFG."

From @fold_app

"Fold is now the latest publicly firm with bitcoin on its balance sheet, holding 1,000 BTC worth $96 million. FLD shares rallied 30% in early action before giving back a sizable portion of those gains."

"Michael Egorov, the founder of decentralized exchange Curve Finance, is working on a new project called Yield Basis and has raised funds for it. Yield Basis aims to initially help tokenized bitcoin and ether holders earn yield from market making by mitigating impermanent loss, according to a pitch deck obtained by The Block.

Impermanent loss is a risk in decentralized finance where liquidity providers can end up with less value than if they had just held their assets, even after earning trading fees or token rewards.

Yield Basis is raising $5 million in a token round at a fully diluted valuation of $50 million, according to the deck dated Jan. 11, 2025. The project is selling 10% of its "YB" token supply — or 100 million tokens out of a total of 1 billion — to investors, per the deck. The vesting schedule for investors includes a six-month cliff followed by two years of linear vesting."

From @TheBlock__

Hype EVM goes live without any forewarning: HYPE unchanged around $25

"The HyperEVM is live. This is a major step toward the vision of housing all finance by bringing general-purpose programmability to Hyperliquid’s performant financial system. The initial mainnet release of the HyperEVM includes:

1. HyperEVM blocks built as part of L1 execution, inheriting all security from HyperBFT consensus.

2. Spot transfers between native spot HYPE and HyperEVM HYPE. As a reminder, HYPE is the native gas token on the HyperEVM.

From @HyperFND

SEC launches crypto fraud unit to combat cyber-related misconduct and to protect retail investors

InfoFi platform Kaito settles around $1.6B FDV with staking announced

"Staking rewards are now live - currently ~10% staked with 70% APR. expect this to normalize over the coming days none of the locked tokens (incl investors/foundation/team) are able to stake source of rewards are currently from Liquidity Incentives but next week onwards this will be a net sink given network fees more on the utility of the staking will be released - some of you have noticed a HODL score which will boost voting rights in Kaito Connect - this is just one aspect Genesis NFT holders and $KAITO stakers will always get priority access to everything we do at Kaito"

Barstool CEO Portnory releases two GREED tokens yesterday and claims to funnel profits into JAILSTOOL

"On the first $GREED token there were three main wallets that bought simultaneously on the very first block. Dave got 35.7% and the other two wallets got 22% and 21.5%. Each of the other two wallets made over $300,000 profit. Including the wallet addresses below. I have no idea if those wallets were working with Dave or if they were snipers who saw a deployment giving his main wallet token and managed to get into the block."

"' @stoolpresidente just launched "Greed 2" in response to criticism of him pump & dumping "Greed". Somehow, people still lined up to donate. Market cap hits $4.4M instantly. He owns 26%."

Sponsored Post - Nounish Cup Receives $500 for DOTA prizepool

This week Lil Nouns DAO voted for a $500 proposal to fund a prizepool for amateur and semi-pro Dota 2 players.

The team says that the Nounish Cup #002 provides a prime opportunity to introduce Dota 2 players and esports fans to the Nouns ecosystem; and fans are much more likely to buy a Lil Noun than a full Noun, so the partnership makes sense.

In terms of brand integration:

Lil Nouns branding will be featured across social media, live streams, and event materials.

Viewers and participants will interact with the Nouns ecosystem through Fantasy League involvement and USDC payments.

The "What is a Lil Noun?" video will keep the community engaged and introduce them to Lil Nouns in a fun, informative way.

It’s cool that this is going to be a global event too, with players from Europe, South America, and North America participating in the open qualifiers.

Have noticed the Lils increasingly aligning with the gaming community with great success recently. Hope it continues well!

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life: check out our website.

Notable Sales - Punks, Bears, Penguins

Band Bear, Berachain - 8.75 ETH

CryptoPunk, Cigarette - 42 ETH

Pudgy Penguin, Pudgy Man - 18 ETH

CryptoPunk, 3d Glasses - 60 ETH

Investment Focus - The $5M Masquerade by Sam Spratt

The Masquerade is the next chapter in the evolving story of Luci by Sam Spratt, the latest 1/1 piece of digital art seamlessly continuing from where The Monument Game left off.

It just sold for $3M to Kanbas, a top digital art collector, and its 613 editions of masks sold for a total of $2.1M.

The way Sam is including his collectors in the Masquerade is what sets him apart from many other artists.

Each mask owner, who purchased a mask for 2.56 ETH, now has two days until Feb 24th to leave an ‘Observation’ up to 512 characters on the 1/1 Masquerade piece itself.

Observing is that first vulnerable act of speaking our mind. Guests of the Masquerade begin by writing words atop the Artwork. A preserved record of human thought. A digital communal varnish preserved within a digital artwork.

What this means is that Mask holders can literally go into the artwork and place an observation on top of the artwork, binding their observation to the artwork forever.

I have always been absolutely convinced that digital art is one of the most obvious guaranteed value props for NFTs.

Whilst many artists struggle, because making art is tough but growing and maintaining a strong collector base over time is even harder, Sam is a clear example of how to thoughtfully output digital art which captivates a base over time.

For further context, Sam’s Skulls of Luci have sold recently between $150,000 - $200,000 as an edition of 50, and the players editions of 256 have been selling for as much as $25,000.

In my opinion these masks will trade at least between $12,000 - $17,000, especially because these are 1/1/613, which means they are each unique (whereas the players editions were all the same).

I will be participating in the The Masquerade and look forward to seeing how it plays out.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters