GM - this is The Snapshot, edition #157.

This is what I’ve got for you this week.

This Week In Web3 - Berachain launches at $7b but falls to $2.5B

Sponsored Post - Lil Nouns x GM Farcaster sponsored for 7.5 ETH

Notable Sales - Punks & Bears

Investment Focus - The MegaETH 10K ETH Raise

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - Berachain launches but dips down to $2.5B

Berachain jumps as high as $7B FDV before pullback to $2.5B FDV

Ondo Finance launches tokenization platform for open onchain access to US securities

"Tokenized real-world asset issuer Ondo Finance launched Ondo Global Markets, a new platform designed to open up onchain exposure to U.S. public securities such as stocks, bonds and exchange-traded funds.

“What stablecoins did for dollars, Ondo Global Markets will do for securities,” Ondo wrote in its Tuesday announcement. “By leveraging blockchain technology, we can bring institutional-grade financial markets onchain, making them more accessible, transparent, and efficient.”

MegaETH announce 10,000 ETH raise via NFT sale for whitelisted wallets

"Rather than relying on forced activities or task farming, we’re emphasizing conviction and commitment—to both MegaETH and the broader industry. We’ve established multiple avenues to distribute and decentralize the MegaETH network. One example is our record-breaking Echo sale, which brought in over 3,200 new investors at the same valuation as Vitalik Buterin, Joseph Lubin, Cobie, and others.

We’re further reflecting these core values with our flagship 10,000 NFT collection. Each NFT will cost 1 ETH and will cumulatively represent at least 5% of the MegaETH network. This allocation is dynamic—designed to increase as the NFT collection evolves. We chose to launch a soulbound NFT collection because it avoids invasive KYC requirements, remains anti-sybil, and uses stringent AML procedures.

The NFT sale will be divided into two installments (“retroactive” and “proactive”), with all sales offered on a whitelist-only basis. We’ve collected more than 80,000 addresses for the first installment and will soon share our methodology publicly. Additionally, no one on the MegaETH team will hold one of the 10,000 NFTs."

From @megaeth_labs

Trump team prepares to launch BTC+ ETF along with Made In America ETF and Energy Independence ETF

"U.S. President Donald Trump’s media company, Trump Media and Technology Group (TMTG), is making moves to launch exchange-traded funds (ETFs), including one tracking the price of bitcoin (BTC), according to an announcement on Thursday." The ETFs — three of them in total so far, alongside other planned products — would be launched under Trump’s Truth.Fi brand. The bitcoin-focused fund, for example, would go under the name Bitcoin Plus ETF. The other two funds are the Made in America ETF and a Energy Independence ETF.

Helium announces first free phone plan in US + Cloud Points in exchange for your anonymised data

"Helium Mobile was born from a simple belief: Access to the internet should be a right, not a privilege. So, we turned the traditional telco model on its head. Gone are the days of overpriced phone bills and your personal data being exploited without your knowledge.

Enter the Zero Plan: 3GB of data, 300 texts, and 100 minutes of calls—completely free. Plus, you earn Cloud Points because with the Zero Plan, you’re rewarded for sharing your anonymized data.* Use your Cloud Points to redeem for gift cards to fuel unforgettable travel, dining, and other life-enhancing experiences."

Movement Labs founder Rushi announces official advisor position to Thailand government on their digital asset rollout

"proud to be an official advisor for the Thailand government via TIDC on their digital asset rollout with @tekinsalimi thailand like many emerging markets are quickly growing their digital asset strategy especially with the american signoff. these regions are most keen for crypto due to weak currencies, underbanked individuals, and eagerness for fast paced markets. few initiatives we’re spending time with: - national stablecoin tokenization and issuance - decentralized training for AI networks - strategic reserves for assets like BTC, ETH, MOVE and more"

@rushimanche of @movementlabsxyz

Sponsored Post - Lil Nouns x GM Farcaster sponsored for 7.5 ETH

This week Lil Nouns DAO voted for a 7.5 ETH proposal by GM Farcaster who proposed a media and event sponsorship package.

This is the full plan:

⌐◨-◨ 2 month sponsorship of GM Farcaster highlighting Lil Nouns on their 3x/week show.

⌐◨-◨ Sponsorship of the GM Farcaster brunch at Eth Denver

⌐◨-◨ Prize pool sponsor for the next season of CastOut

⌐◨-◨ Launch of Lil Poker, a GMFC new stream

⌐◨-◨ Budget for Lil Nouns purchases on auction for giveaways/prizes

A nice combination of irl and online events.

Prof is also one of the legends in the Lils/Nouns community so great to see her being supported here!

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life: check out our website.

Notable Sales - Punks & Bears

CryptoPunk, Hoodie - 206 ETH

Bond Bear, Berachain - 140 ETH

CryptoPunk, 3D Glasses Red Hair - 88 ETH

CryptoPunk, Bond Bear - 69 ETH

Investment Focus - The MegaETH 10K ETH Raise

megaeth position themselves as the first real time blockchain. this is very important for one particular reason.

solana has crushed ethereum this cycle. it is faster, more popular, captured the majority of meme coin activity, is attracting more developers…and its price has gone up the most ($8 to $200 now). this is the sol/eth chart.

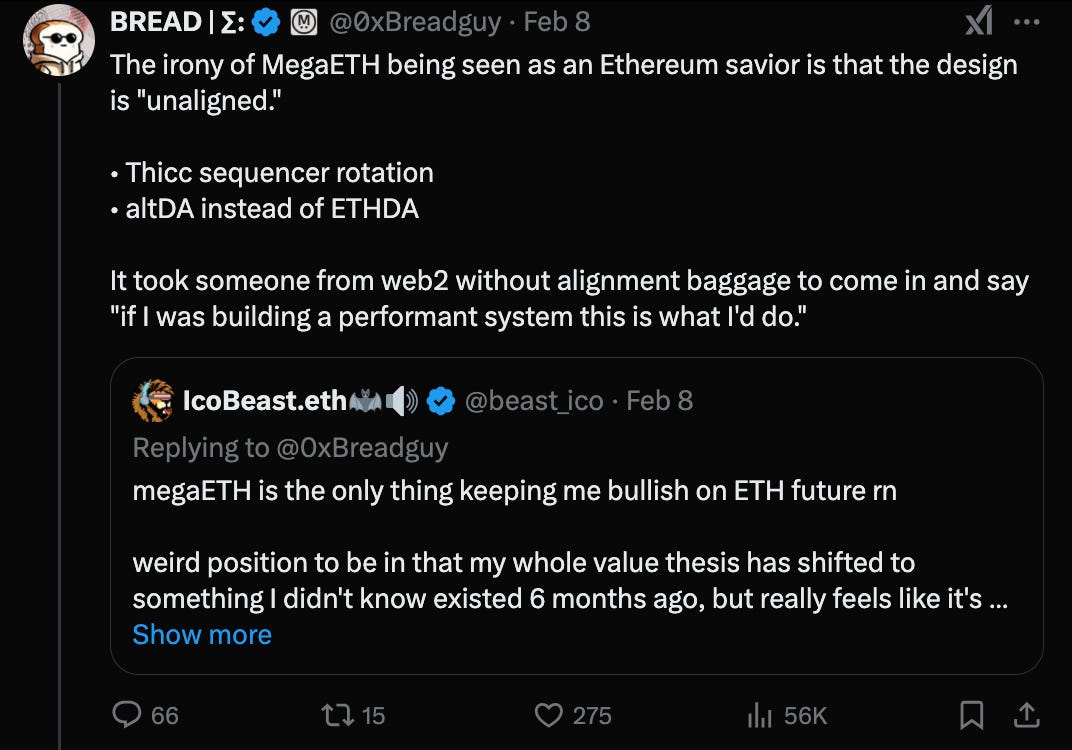

how has ethereum responded?

well, lots of l2s were due to come to market because the thinking was that eth needed to be cheaper and faster, because mainnet was too expensive and slow to handle more transactions.

this was definitely true.

and so lots of l2s launched as part of the ‘superchain’ - built on the OP stack. - and otherwise. but there were problems for eth with this approach.

now liquidity is very fragmented, and because of the incentives baked into the construction of l2s, very little value is accruing to eth the asset (l2s manage to keep a lot of the fees they create.)

in addition, the eth foundation has been accused of provided lacklustre support to many of its builders, whereas solana’s more centralised marketing is positioning itself nicely as the app store of the blockchain.

so how does megaeth fix this for eth?

whilst it doesn’t fix some of these issues - they are basically trying to build the most performant chain possible, even if it breaks away from some traditional eth alignment.

so megaeth is trying to MAKE ETHEREUM GREAT AGAIN by making it faster and - i would argue - make it more culturally relevant again.

so on to the 10k eth raise.

10k ETH is a $26M raise.

crucially these NFTs represent a minimum of 5% of the network.

that means MegaETH is valuing itself in this raise at $26M x 20 = $520M.

interestingly these NFTs will unlock 50% at TGE. This means that a minter would need MegaETH to come out at just over $1B to break even with liquid MEGA tokens, with 50% of the rest of their tokens to vest.

what is more - the tokens vest entirely over 6 months (which is very short relative to other vesting periods) + that can actually be sped up by hitting certain KPIs (yet to be revealed).

so all of those details are very attractive.

why they mega are doing this type of raise

so what value will mega come out at?

the most valuable l2 is mantle at more than $6b fdv. most well known and valuable l2s are probably optimism and arbitrum at around $4.5b. zksync and starknet are in the $2b region. on the other side, there are l2s at $500m FDV or less - so it’s not like L2s can’t come out at less than the value of megaeth’s valuation here.

it’s worth noting as well though - berachain - a new l1 - has just come out at around $2.5b. i mention this because i get the sense megaeth is not gunning to be another l2 - this is meant to go against solana ($120B). hyperliquid, which has attracted huge on chain activity and is printing on fees, are also planning an l1 and they are currently at $23b.

unless the market is completely cooked for whatever reason - i could see mega working its way towards between $2-$4b early on, maybe even higher on the potential (subject to market, testnet going well + mainnet working as planned + more detailed tokenomics to see how much circulating supply they go for).

for that potential to be actualised (+ go higher), their focus on apps needs to materialise with some hits that drive real volume + generate significant fees.

let’s see how they go.

i will be minting, experimenting on chain - which is obviously the best way of assessing their progress - and watching closely how they execute & control the narrative.

if you are curious to learn more on the details for the mint, you can do so here.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters