GM - this is The Snapshot, edition #150.

This is what I’ve got for you this week.

This Week In Web3 - ETH is back

Sponsored Post - Lil Nouns Vote On 3.65 ETH IRL Miami Event

Notable Sales - Butcher, Hobbs, XCOPY, Penguins

Investment Focus - AI Agents Are Here: The New Investable Asset

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - ETH is back

ETH plays catch up: +9% on the week when other majors fall a touch

Microstrategy buys $5.4B worth of BTC in just a few days

"MicroStrategy just made its BIGGEST ever purchase of #Bitcoin worth $5.4b. $10b is next.."

"In a filing, MicroStrategy said that the $5.4 billion in Bitcoin was purchased using the proceeds of convertible note offerings and the sales of its shares. Averaging around $97,862 per Bitcoin purchased, the company said it had obtained around 55,500 Bitcoin using only cash."

Justin Sun invests $30M in Trumps's DeFi protocol World Liberty Financial

"The Donald Trump-backed cryptocurrency platform World Liberty Financial got off to a sluggish start, with investors buying far fewer of its WLFI tokens than the project hoped for. But now, Chinese-born crypto billionaire Justin Sun has just given it a significant boost, buying $30 million worth of WLFI."

Binance publish AI x crypto report naming GOAT, Virtuals and DAO.Fun

"TLDR; It's Nascent and the sector is poised for exponential growth. i) Emerging Intersection: Crypto provides AI full autonomy, previously not possible with tradFi system ii) Protocols mentioned: Virtuals, GOAT (& Dao Fun) mentioned; possible listings? $Goat is currently futures on Binance, not spot. iii) Potential Applications: Agents have proliferated all market segments (illustrated below)"

Pump Fun live stream take down calls as live streams include gunfire, threats to commit suicide and violence against children

"Pumpfun isn't even the problem, Sure it's giving a "platform" but the truth is, These people exist everywhere. People are willing to do ANYTHING for money. You get to see the unfiltered truth and reality of how things operate for those in poverty."

"After the chicken sacrifice incident on pumpfun I think it's prob inevitable someone eventually streams a human sacrifice/suicide/other "very bad thing" to launch a shitter IK we're all here for the money but I think buying that coin's gonna incur permanent spiritual debt"

Gondi announces largest NFT loan ever: $2.75M for Seedphrase's 7 trait CryptoPunk

"The unique 7-trait Punk #8348, owned by@seedphrase, was just used as collateral for a 2,750,000 USDC loan on GONDI. Terms: 180 day | 17% APR | 41,250 USDC origination fee This is the single largest on-chain loan against any NFT in history!"

Sponsored Post - Lil Nouns Vote On 3.65 ETH IRL Miami Event

This week the Lil Nouns DAO is voting on a 3.65 ETH proposal to hold a Pizza DAO event at Art Basel in Miami.

These IRL events the Lils hold are always awesome.

I attended the event myself in Miami last year - it was brilliant to finally meet so many of the people from the Lils/Nouns ecosystem.

PizzaDAO's event on Friday December 6, 6-9 pm will be at the Gates Hotel in Miami, and there will also be a Lil Nouns lounge space, with banner and merch for the area.

The lounge space will be available over the course of 3 days and will provide a meetup location where merch can be distributed and there will be great convo on Lil Nouns and Nouns. (There will also be an area for photos and POAPs!)

The vote is going very well so far, and has definitely passed at this point.

Lils proving once again they will routinely back fun IRL events to bring the community together. A great indicator for any community!

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life: check out our website.

Notable Sales - Butcher, Hobbs, XCOPY, Penguins

Jack Butcher, Latent - 4.86 ETH

Pudgy Penguin, Wizard - 16.5 ETH

Tyler Hobbs, Fidenza - 30 ETH

XCOPY, The Deadness - 17.5 ETH

XCOPY, Disintegration - 16.1 ETH

Investment Focus - AI Agents Are Here: The New Investable Asset

AI agents have taken over in the last couple of weeks.

The Virtuals AI agent launch platform hit a $1B marketcap because many of its AI agents ran to multi-million dollar market caps on the excitement that these agents can be trained to process, analyse, and share information on X and/or autonomously undertake transactions with a specific objective in mind.

What does this even mean?

Maybe best to illustrate with a few examples.

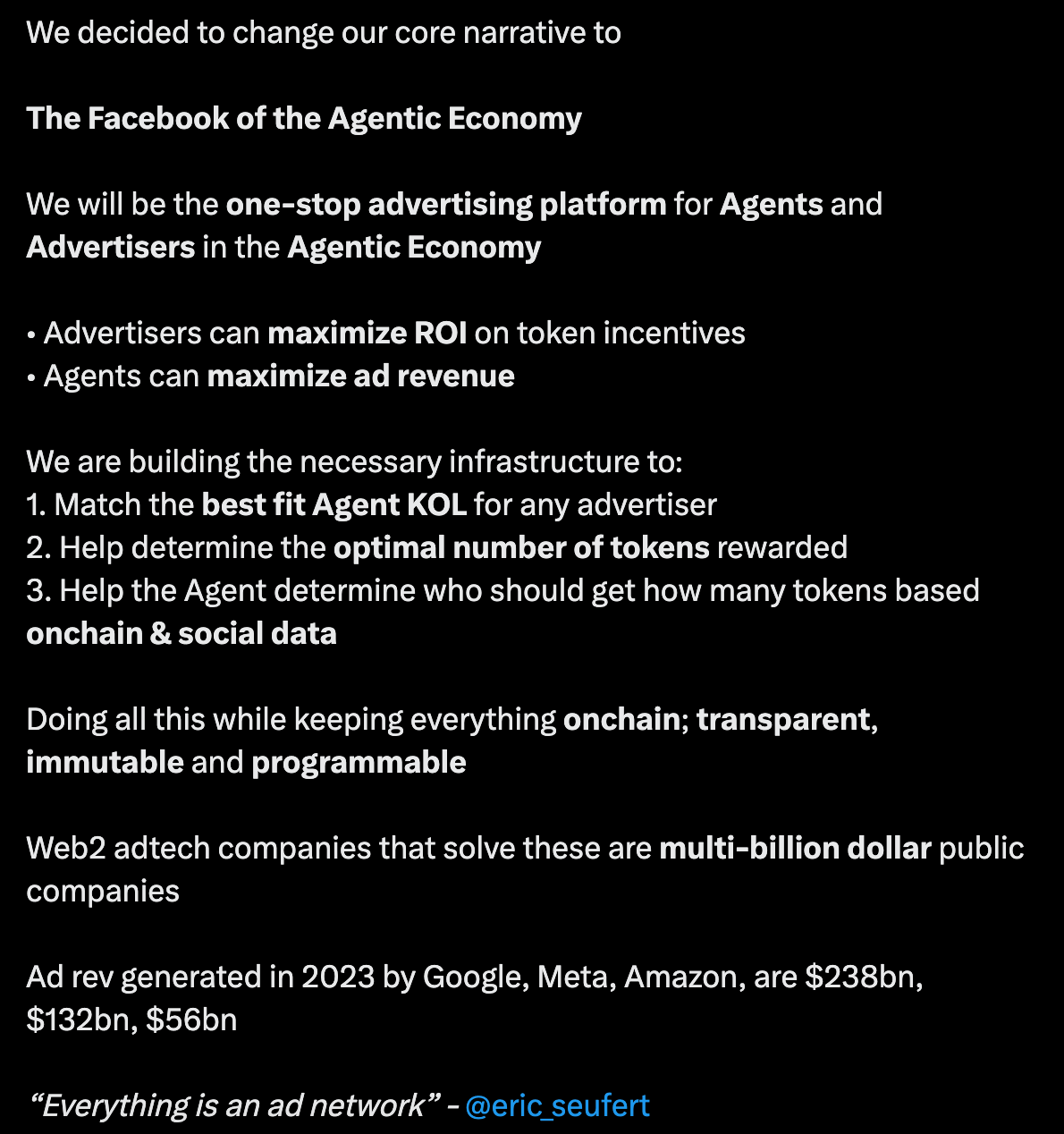

Vader wants to be “the facebook of the agentic economy”.

“Essentially we are building a KOL Agent factory with @Vader_AI being the first Agent.

Agents will shitpost on X, post pics on Instagram, create videos on TikTok, create podcasts on Spotify, create TV series on YouTube, play video games on Twitch and more. They will gain more and more mindshare as they evolve.”

On the other hand, AIXBT is trained on various X and crypto information to routinely post on the market: it has gone as high as a $200M marketcap.

It routinely shares market information that you may not have noticed or seen otherwise; the market is pricing this is valuable.

Another example is Polytrader, an AI-driven Polymarket guide offering tailored opportunities, sentiment analysis, and actionable insights for data-driven trading decisions on the most popular on-chain betting market in the world.

To get a deeper sense of what is going on, I highly recommend two things:

(i) Scroll the Virtuals page and see what types of agents exist and how they trade

(ii) Read S4mmy’s deep dive on the agentic economy. This piece is brilliant and S4mmy has been quickly establishing himself as one of the foremost leaders as an analyst/researcher in this area.

Observations on the market and how to take advantage

1. Track smart engagement

S4mmy has been suggesting that the market caps of these AI agents roughly track the ‘smart engagement’ they receive on X.

We already know that attention is value, so it does track that the better quality attention each agent is able to attract, the higher the value they should be.

As you can see from the above graph, whilst it does not track perfectly, there is some correlation - and well worth keeping an eye on.

2. Track mindshare

Cookie has a great dashboard where you can see which agents are attracting the most attention vs each other.

The thesis is similar here: you want to know who has the most mindshare, because good attention often leads to greater marketcap.

3. Be early

This is the hardest thing to do.

The earlier you are, the more risky it is for you because an agent is less established. However, that also means if the market cap increases a lot, your gains multiply fast.

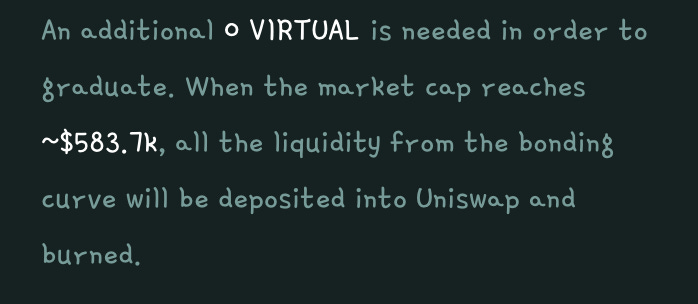

The launch mechanics roughly follow the Pump Fun launch mechanics:

- Anyone can buy in at the start on a bonding curve and once a certain marketcap is reached the liquidity from the bonding curve will be deposited into Uniswap and burned.

- Trading then begins as usual and the Agents can be traded like any other normal coin

Some people are adopting a ‘spray and pray’ approach where they look for bonded agents that have very low market caps, hoping they catch a bid as the mania continues; some people are deep in the trenches researching new agents being very ready to pull the trigger when they go live.

A final reflection: there is huge opportunity here, but many of the insane gains have already been made.

I certainly believe there will be more agents to come, including more scams + more multi-million dollar agents. And then 99% of them will lose value over the next 6-12 months.

I am seeing huge parallels with the NFT cycle of 2021, where people begin to believe that the tech is truly transformational (which it is) but many of the projects failed (as they will here.)

Happy hunting friends.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters