GM - this is The Snapshot, edition #141.

This is what I’ve got for you this week.

This Week In Web3 - $MOODENG MANIA

Sponsored Post - Lil Nouns Allocates 6 ETH For LA Nouns Town Event

Notable Sales - XCOPY, Autoglyph, Azuki, Cherniak, Videodrome

Investment Focus - Why I Invested $18k In Infinex: The $65M Raise

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - $MOODENG MANIA

Memecoin mania continues as $MOODENG runs wild to $250M FDV

"SHIB just added a cool $3.3B in market cap today. That’s more than WIF ($2.1B) and POPCAT ($1B) combined"

"NEW: $MOODENG (@MooDengSOL) BECOMES THE LARGEST MEMECOIN BY MARKET CAP LAUNCHED ON @pumpdotfun"

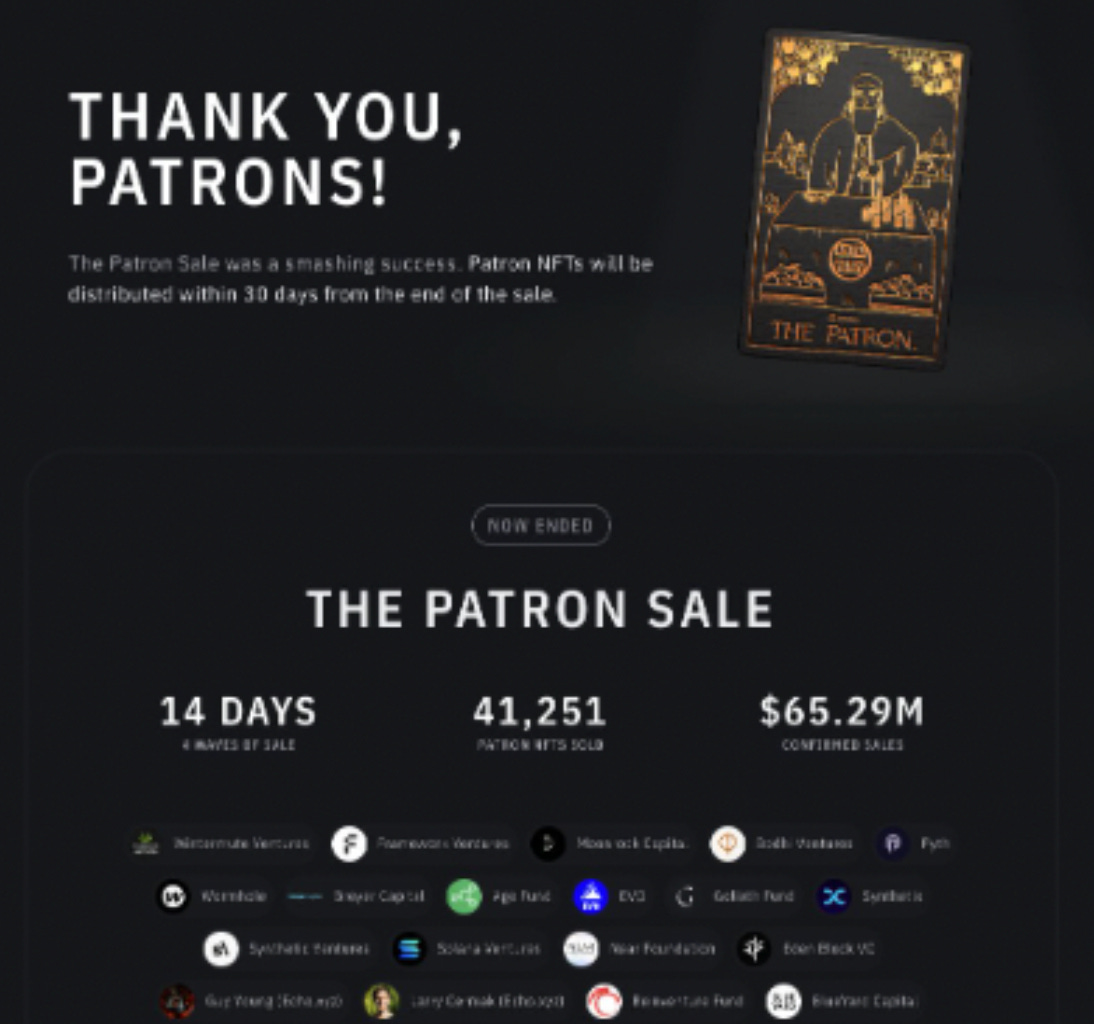

Infinex completes $65M raise for decentralised alternative to CEX

"@infinex_app raised more $65M USD with the fairest sale structure the market has seen for years, while building sth that could revolutionize DeFi and on-chain UX."

From @sjdedic

Paypal enables US Business accounts to buy, hold and sell crypto

"Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency," said Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies, PayPal. "Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers. We're excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly."

Ethena to launch new stablecoin backed by Blackrock's tokenised BUIDL fund

"Securitize is proud to partner with @ethena_labs for the planned launch of UStb, a new stablecoin which intends to invest its reserves in @BlackRock ’s tokenized U.S. Treasuries fund, BUIDL. As the largest tokenized U.S. Treasuries fund with over $522 million in assets, BUIDL provides UStb with a secure foundation. This collaboration represents a key milestone in the evolution of tokenized finance, bringing together leading innovations in stablecoins and real-world asset tokenization."

"UStb would exist as a “wholly independent product,” offering an alternative and completely different risk profile compared to Ethena’s existing USDe stablecoin, the team said."

"Crypto-based prediction market platform @Polymarket is seeking $50 million in fresh funding, according to an article Monday in tech news site The Information. The New York-based startup is also considering issuing its own token, according to the article, which cited unnamed sources."

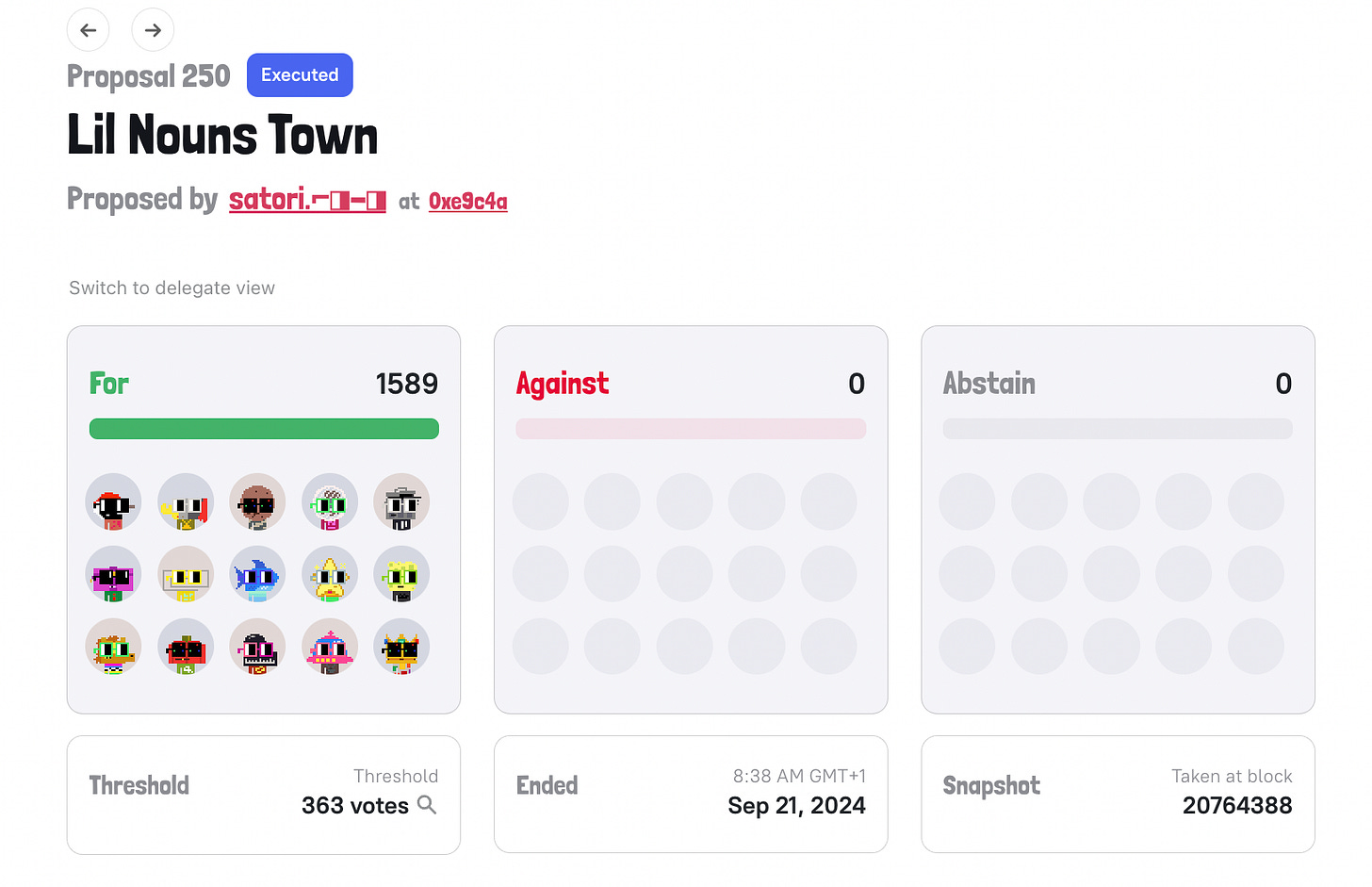

Sponsored Post - Lil Nouns Allocates 6 ETH For LA Nouns Town Event

Lil Nouns DAO has passed a 6 ETH proposal to give Lil Nouns an IRL presence at Nouns town in LA.

What are the details?

Nouns Town 2024 is the perfect platform for Lil Nouns to make a splash and showcase its playful, inclusive vibe. By bringing interactive elements such as a take-home CC0 art gallery, live nounish caricatures, yard games, and engaging kendama activities, this event will give Lil Nouns a chance to stand out. This playful experience will reinforce Lil Nouns' unique character within the broader Nouniverse.

Love to see the Lil Nouns DAO support spilling over into the IRL events scene.

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life: check out our website.

Notable Sales - XCOPY, Autoglyph, Azuki, Cherniak, Videodrome

XCOPY, The State Of Us - 55 ETH

Autoglyph - $413,000

Azuki, Water - 17.5 ETH

Cherniak, Ringers - 12 ETH

Videodrome, AI Generated Nude - 200 ETH

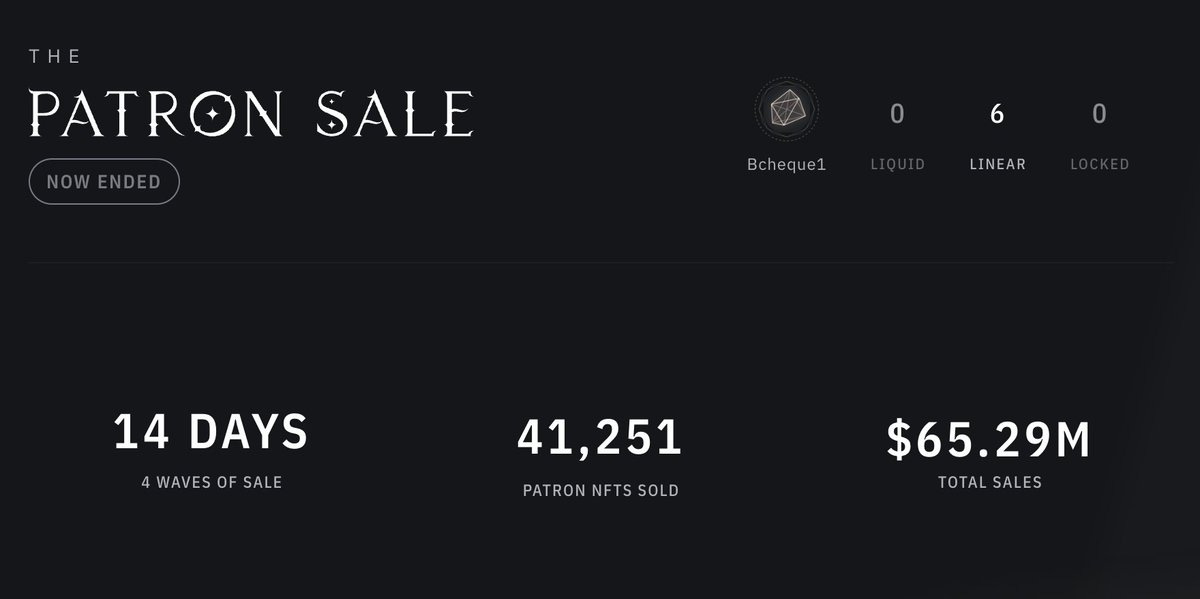

Investment Focus - Why I Invested $18k In Infinex: The $65M Raise

This is a breakdown of the biggest recent public crypto raise + my thoughts on allocating $20k.

1. the numbers

infinex raised $65.29M from the sale of 41,251 NFTs here is the crucial breakdown and the maths:

there are 100k nfts, half of which were for community sale (some of which were pre-sold to select investors)

there were 3 different types of nfts you could buy, each offering a different discount depending on the vesting period

so 41k were sold in the end, and the value of those nfts were $65.29M so that means on average each NFT was bought for 1.59k which means the FDV for the whole collection is 1.59k x 100k = $159M

from those numbers, it looks like the majority of buyers must have bought in at $1250, which means a 12 month cliff, and a 24 month unlock

crucial to note:

if you buy 1 nft for $1250, you receive your nft at the end of the 24 months after the 1 year cliff (36 months later)

if you buy 24 nfts for $1250, you receive 1 nft per month during the 24 month unlock, after the 1 year cliff

if you buy 6 nfts for $1250, you would receive 1 nft every 4 months etc (so the number of nfts you buy helps speed up your unlocks )

because so many have bought the 1 year cliff option, and even then, the nfts will unlock over 24 months, there is a reasonable chance that circulating supply of nfts is less than 10% at the beginning - maybe much less

even if it was only 10% circulating supply, that's a marketcap of $16M (low for this imo - more strategy on my buy later)

2. the founder

founder is @kaiynne og founder of @synthetix_io in the gangster snap from singapore with a load of eth legends - Largest lending protocol (@aave) - Fastest growing stable (@ethena_labs) - Fastest growing perpex (@HyperliquidX) - Fastest infra sewn (@megaeth_labs)

3. investors

backed by a lot of people i like @LucaNetz @JasonYanowitz @0xMert_ @gmoneyNFT @RuneKek and a lot more. tbh scroll the @infinex_app account and they shared many of the investors

4. the app

the plan is to build an alternative to a cex - a place where you can do all of your on chain things not in a cex, and instead of jumping around all the time between different chains / dapps.

that means one place for all eth activity/solana/l2s - sounds useful to me

even more useful is their next stage of development, where they intend to bring on board a whole load of features like lending, staking, nfts, launchpads, yield farming etc (this should cut down the number of tabs i have open, which is great)

and the ux is really good

when scrolling the account, it was probably the #1 thing popular investors mentioned as the best thing about the app so far (that and onboarding flow)

5. singapore

they had great events

6. final thoughts

- seems undervalued at this price

- app is ambitious but legit needed - i know because i myself am tired of jumping around different places to do things on chain

- buying most discounted nft at $1250 is good on price, but bad on timeframe, as you are looking at a 2-3 year wait for your nfts if you aren't going in with serious size - im not looking to miss the bull market like this

- buying $5k no cliff nft i bet works out fine - though i couldn't bring myself to do it cos it's so much more on price

- i preferred the $3k no cliff 12 month vesting nft - because majority of ppl bought in at $1250, my effective valuation is still $159M - i just pay a premium for getting hands on my nfts sooner (i got 6 so will receive 1 every 2 months for a year) + gives me the optionality/liquidity of the nfts as year progresses

*all of this assumes this becomes liquid, either by literally becoming an erc20, or something is done to really drive value to the nfts. we hope many sophisticated investors did not invest millions into just a “commemorative nft” lol

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters