#137 Sell In May And Walk Away: A Summer Review

Why Is Sentiment So Bad If BTC Is The Same Price As In May?

GM - this is The Snapshot, edition #137.

This is what I’ve got for you this week.

This Week In NFT World - $35M for Trump NFTs as SEC investigates OS

Sponsored Post - Publish & Profit #3: Aggregating Over Creating

Notable Sales - Punks, XCOPY, Helena Sarin, ACK

Investment Focus - Sell In May And Walk Away: A Summer Review

For sponsorship enquires, please DM me on Twitter.

Have a great day,

B

This Week In NFT World - $35M raise for Trump NFTs as SEC investigates OpenSea

Telgram coin $TON drops out of top ten crypto coins after founder Pavel Durov arrested in France

$KEROSENE up another 35%, now up 300% in 7 days, related to new stablecoin DYAD

"Each DYAD stablecoin is backed by at least $1.50 of exogenous collateral. This surplus absorbs the collateral’s volatility, keeping DYAD fully backed in all conditions.

Kerosene is a token that lets you mint DYAD against this collateral surplus. Kerosene can be deposited in Notes (the DYAD NFTs) just like other collateral to increase the Note’s DYAD minting capacity.

The surplus is the total DYAD stablecoin supply subtracted from the value of all collateral in the protocol. Each Kerosene token’s value is this surplus divided by the total Kerosene supply.

Note holders can now earn Kerosene by minting DYAD. Eventually, users will also have the option to earn Kerosene by providing liquidity for DYAD and staking the LP tokens to their Notes."

From @0xDYAD

ETH Foundation reveal $100M a year budget to some fury over lack of transparency

"This is part of our treasury management activities. EF has a budget of ~$100m per year, which is largely made up of grants and salaries, and some of the recipients are only able to accept in fiat. This year, there was a long period of time when we were advised not to do any treasury activities due to the regulatory complications, and we were not able to share the plan in advance. Also this transaction is not equal to a sale. There will be planned and gradual sales from here on."

"It's a big issue that it takes people raising a fuss on Twitter to ever get ANY info out like this. Seriously, how hard is it release a quarterly report with financials and basic updates? Expenses, expected upcoming sales, how/where the money is being spent, team size and distribution, etc."

Trump launches third NFT collection: 360k cards at $99 each; seeking $35M raise

"If Trump sells out his newest Trump Digital Trading Cards NFT collection He'll make $35,640,000. 360,000 possible cards, $99 each"

OpenSea receives Wells Notice from SEC threatening to sue because they believe NFTs are securities

"By targeting NFTs, the SEC would stifle innovation on an even broader scale: hundreds of thousands of online artists and creatives are at risk, and many do not have the resources to defend themselves. NFTs are fundamentally creative goods: art, collectibles, video game items, domain names, event tickets, and more. We should not regulate digital art in the same way we regulate collateralized debt obligations."

Sponsored Post - Publish & Profit #3: Aggregating Over Creating

One of the biggest issues for creators is deciding the WHAT. What should I create? This is an issue first because people think of creating as a 0-1 endeavor, a huge lift, where you start with a blank canvas and paint a masterpiece - and second because people are scared of other people’s opinions and reactions to their work.

Leaving the second reason for now, it is simply not true that creating has to be a huge lift if you are an expert in a particular field.

Sometimes people wonder how I produce The Snapshot - a daily NFT and crypto market round up on X every day, but the truth is I’ve built up all of the right follows on X after the last couple of years, so I see all the main news each day - so all it takes is making a note every time I see something headline worthy - and then sifting through the potential headlines each morning and finalizing the shape of the news.

The value is in that aggregating. The key thing here is that I am not really “creating”: I am taking all of the news from around the space, aggregating it and organising it in a way which hopefully makes sense to people.

There is a huge opportunity for creators to build loyal audiences through this because there is so much information out there, it all lives in different places, and people want it in one place.

Here are some people who I personally follow for particular niches:

For general crypto market stuff, Mando produces some of the best daily updates for macro and crypto with a hint of a ‘left curve’ corner, and Tyler is also excellent with breaking updates throughout the day with a real specialism in the NFT market.

For art, Roger Dickerman’s 24 Hours Of Art is excellent for its daily highlights of notable digital art sales including the stories behind the art, and I still like An from Superrare’s art market report newsletter too.

A great example of a chain aggregator is Untamed Adam, who produces excellent daily updates on the Blast ecosystem and has basically become the hub for knowledge in the Blast arena.

And a new Defi newsletter I am enjoying is Danger’s Today in Defi newsletter which shares new DeFi opportunities daily after assessing the market and presenting the best options.

The key takeaway for me is this: never underestimate how interesting and unique your personal interests and curiosity is, and even if you don’t aggregate a whole market which might sound too burdensome, the beauty of the internet is that even just aggregating your niche should find an audience.

This segment is brought to you by @lilnounsdao, an expansion DAO based on the famous @nounsdao, who fund cool creative endeavors which proliferate the Nounish meme.

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life: check out the Lils website.

Notable Sales - Punks, XCOPY, Helena Sarin, ACK

CryptoPunk, Top Hat - 32 ETH

XCOPY, Resist - 9.55 ETH

ACK, Star Palette - 15 ETH

Helena Sarin, Forget Me Not - 12 ETH

CryptoPunk, Cowboy - 45.99 ETH

Investment Focus - Sell In May And Walk Away: A Summer Review

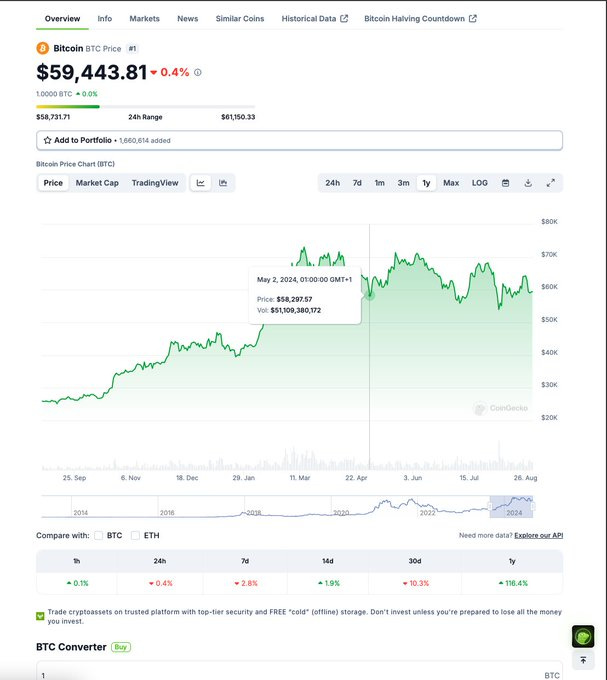

they say sell in may and walk away: on may 2nd btc was at $58k today 3 months later btc is at $59k so why is sentiment so much worse?

1. after btc hit aths in april, people expected us to go much higher sooner it is the expectation of going higher that creates disappointment when we stay the same

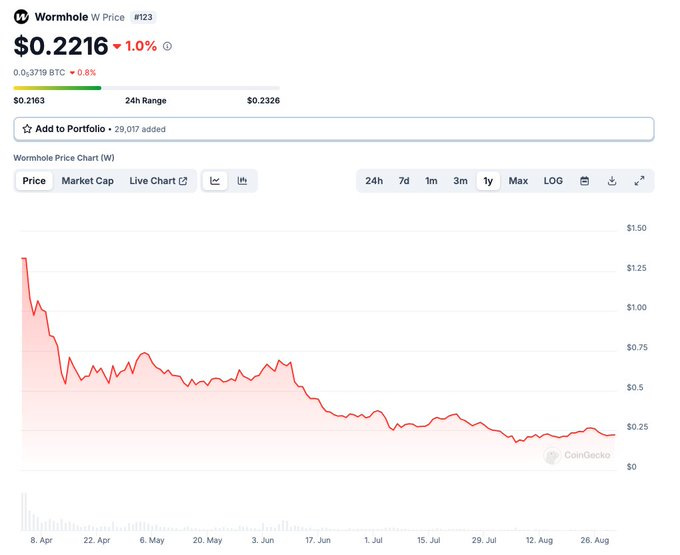

2. april was 'airdrop season' - multiple projects decided to drop tokens in march/april and they came out at great valuations (but that token drop activity has disappeared over the summer so no injection of capital/excitement)...

3. most of those tokens which did drop were down only. creates a negative atmosphere when everyone is racing to sell all the time

4. meme gambling has gone into overdrive in the absence of anything better to do. pumpfun accelerates this. very few win in this game, vast majority lose routinely. creates a negative atmosphere, again

h/t @crypto__kermit

5. stock market has ripped aggressively, with nvidia leading. crypto feels left out of risk assets moving

conclusion: i think this is a great time to be in tbh

- rates coming down

- governments addicted to spending

- etfs provided excellent vehicle for institutions to participate

- summer coming to an end

(market doesn't care what you did over the summer, if you over gambled, over leveraged etc)

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters