GM - this is The Snapshot, edition #78.

Welcome to the new subscribers this week - we are now at 1,893 subscribers!

I write about NFTs/crypto, and solopreneurship in web3.

This is what I’ve got for you this week:

This Week In NFT/Crypto World - $10.6M Alien CyptoPunk buy?

Sponsored Post - Lil Nouns Sponsor Barcelona Speakers for 3.8 ETH

Notable Sales - Hoodie CryptoPunk, Cherniak, Hobbs

Thought Piece - Why NFT Lending Is The Greatest Unlock

For sponsorship enquires, please DM me on Twitter.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

Have a great day,

B

This Week In NFT/Crypto World - $10.6M Alien CyptoPunk buy?

Nouns DAO proposes $10.6M Alien CyptoPunk buy

Why do the Nouns DAO, who hold 28,000 ETH ($54M+), want to bid so much for this famous and rare NFT?

A few reasons (one far more politically intriguing than the others!)

It’s cool and a cultural fit for a web3 native DAO

It would be a great marketing play

It was put up for sale for $10.6M

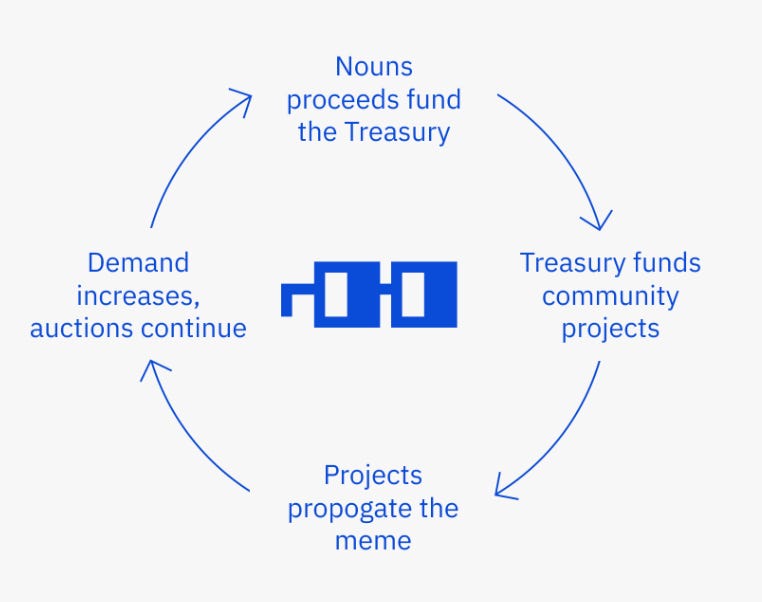

There is an attempt by a certain number of Nouns NFT holders who want to leave the DAO - AND - they want to take their “share” of the treasury with them. (Remember: a new Nouns NFT is sold each day, for around 20 - 30 ETH, and those funds go straight to the DAO to do cool stuff. Some background: the DAO leverages the attention economy to keep generating more interest in Nouns NFTs at high prices. This model explains it well - and you can read more context here.)

Some *rumours* suggest: the happy Nouns holders do not want the unhappy Nouns holders to be able to leave the DAO with significant funds - and so want to deplete a significant proportion of the treasury.

One of the founders did not give this reason for the proposal.

After the original proposal was cancelled and resubmitted at a slightly lower price, he preferred to focus on the fact Nouns can stand for radical experimentation (including in the cultural realm).

It's an interesting idea and I don't think the original proposer should have cancelled. I also think it's contradictory for the DeFi oriented DAO participants to advocate radical experimentation in the realm of financial engineering, governance pools, and so forth and then lambast culture-oriented participants as being irresponsible for making equally bold moves in the realm of cultural expertise. There are CT friends that I respect both FOR and AGAINST this prop and I think we should put it to a vote and let the DAO decide. I thought the previous bid was too high, so I'm resubmitting at 4769. Good luck to all parties!

Naturally there are challenges when operating a DAO where individuals have invested huge amounts of capital and so want to influence treasury decisions. Nevertheless, Nouns remain one of the most fun and interesting experiments in the crypto ecosystem - it’s hard to understand and may be political at times, but so cutting-edge and worthwhile to explore.

We will let democracy decide on the Alien CryptoPunk! And you can track the vote here.

Yuga Labs launch on chain verification for Bored Ape Builders

IP was all the rage in the first year of NFTs: “wouldn’t it be so cool to leverage the NFT which you own to build a product?”

Very few really had the appetite for that challenge though. And the opportunity for scams was rife as there was no way to verify if something was truly built by a verified NFT holder.

That changes now.

The Yuga Labs team, founders of the Bored Ape collection, will ship an online-directory which will include products/services built and delivered by on-chain verified Bored Ape NFT Holders.

You may wonder: what’s the point?

2 points:

The Bored Apes are still a premium collection and that “stamp” of approval could be worth the cost purely as a marketing/attention play;

The Bored Ape holders are known to be some of the wealthiest in crypto: it is not just about quantity of eyes on the product; it’s about quality of eyes on the product.

How will Yuga Labs clarify that these are “verifed” but not “endorsed” by Yuga Labs?

I suspect some very expensive lawyers are drafting some strong terms and conditions as we speak!

Sponsored Post - Lil Nouns Sponsor Barcelona Speakers for 3.8 ETH

Lil Nouns DAO has sponsored a group of Spanish builders for more than $7,000 to attend ETH Barcelona and proliferate the Lil Nouns spirit.

Why did the team win this proposal?

They are a diverse group of builders from both within and outside of the Nouns ecosystem; they have proven track records of hosting marketing and IRL events; and ETH Barcelona was deemed to be an appropriate location WITH an appropriate audience for Lil Nouns to be heard.

They are even going to be giving out T-shirts!

If you are curious about contributing to a cutting-edge DAO and getting paid to bring your ideas to life:

Check out the successful proposal for more details or reply to this email with any questions you’d like me to answer.

Notable Sales - Hoodie CryptoPunk, Cherniak, Hobbs

CryptoPunk, Hoodie VR- 217.5 ETH ($404,000)

Dmitri Cherniak, Ringers - 50 ETH ($94,000)

Tyler Hobbs, Fidenza - 65 ETH ($121,700)

CryptoPunk, Classic Shades - 62.25 ETH ($116,500)

Thought Piece - Why NFT Lending Is The Greatest Unlock

The NFT Lending Market beats the IRL Lending Market every time. Here is why.

The cost of liquidating a fine Rembrandt painting is high: storage, insurance, Sotheby's or Christie's need to find you a buyer too - a service for which they take a handsome cut.

As such, you can get approx. 30% loan to value on the best art.

In the NFT market, the cost of liquidation does not exist:

you simply sell to the highest bidder

ANDyou can see perfect transaction history to know an asset's real value (the traditional art market is not so easily transparent)

As such you can get 60-70% loan to value on the best NFTs. And as a lender you can get great rates in certain situations too.

This is why I lend against NFTs: I have an edge because it's a market I know - but the premium digital asset is simply a more transparent, liquid market.

Here are some loans I have given out recently and the rates I have received.

Why is the DeGod rate so high when only 44% LTV?

Because I gave this loan out when the DeGods floor price was much lower, so the LTV was much higher back then (which usually means you get a higher rate).

Please remember - none of this is financial advice. This is an incredibly new technology in a very volatile market.

Please exercise your own judgment and feel free to reach out if you have any questions.

Next week we talk about perpetual lending: a game changer for the lending industry.

Have a great day,

B

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. It is for informational and educational purposes only.

I hold some of the NFTs mentioned in these newsletters